Introducing Project Tags on Oriole Insights!

With this update, we’ve added project tags to every listing inside the UP/DOWN Prediction Markets. Each project is now marked with tags that identify the categories to which it belongs, making navigation easier and more intuitive. In the near future, tags will also be rolled out across ROI & Initial Listing Prediction Markets.

The goal is straightforward: improved categorization, faster search, and a smoother experience for all platform users. Tags also work as an additional filter, letting you narrow results to the exact type of projects you’re looking for.

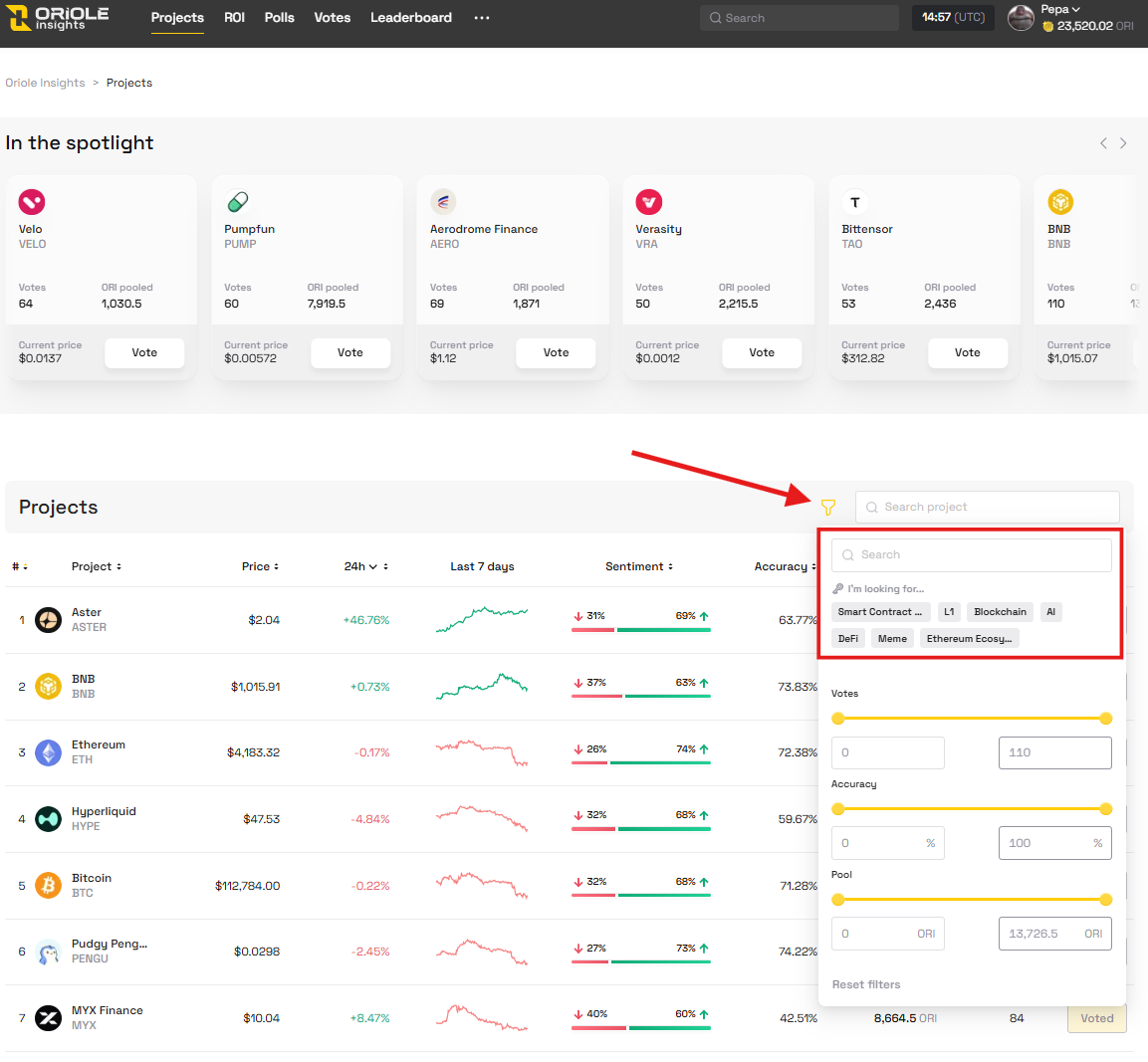

To try it out, click on the filter icon (see screenshot) and type the category you want in the search bar.

Now, let’s take a closer look at which categories exist today and what each of them means.

Available Categories

Here’s a breakdown of all the categories currently available, along with a short explanation of what each tag means.

Smart Contract Platform – Blockchains that allow developers to build and deploy decentralized applications using programmable smart contracts. (Ethereum $ETH, Solana $SOL, Near Protocol $NEAR, etc.)

L1 – Base layer blockchains that operate independently and provide their own security and consensus. (Bitcoin $BTC, Plume Network $PLUME, Sui $SUI, etc.)

Blockchain – General-purpose blockchains that serve as decentralized networks for transactions and applications. (BNB $BNB, Toncoin $TON, Linea $LINEA, etc.)

AI – Projects that integrate artificial intelligence into blockchain use cases, such as data processing, automation, or AI-powered applications. (Rice AI $RICE, Sahara AI $SAHARA, PublicAI $PUBLIC, etc.)

DeFi – Projects that provide decentralized financial services such as lending, trading, or yield optimization without intermediaries. (yearn.finance $YFI, Polkastarter $POLS, Chainlink $LINK, etc.)

Meme – Cryptocurrencies that are built around jokes, internet culture, or viral hype, often without intrinsic utility. (Dogecoin $DOGE, Pepe $PEPE, Melania Meme $MELANIA, etc.)

Infrastructure – Projects that provide core tools, protocols, or services enabling other blockchain applications to function and scale. (RedStone $RED, Fuel Network $FUEL, Safe $SAFE, etc.)

GameFi – Projects that combine gaming with blockchain-based finance, where players can earn, trade, or own in-game assets. (Axie Infinity $AXS, Hamster Kombat $HMSTR, Engines of Fury $FURY, etc.)

NFT – Projects centered on non-fungible tokens, enabling unique digital assets such as art, collectibles, or virtual items. (Pudgy Penguins $PENGU, APENFT $NFT, Puffverse $PFVS, etc.)

AI Agents – Projects that use autonomous AI-driven agents to perform tasks, interact on-chain, or support decentralized applications. (Virtuals Protocol $VIRTUAL, HyperGPT $HGPT, ai16z $AI16Z, etc.)

EVM – Blockchains compatible with the Ethereum Virtual Machine, allowing developers to run Ethereum-based smart contracts and tools. (Arbitrum $ARB, Berachain $BERA, IoTeX $IOTX, etc.)

L2 – Scaling solutions built on top of Layer 1 blockchains to increase speed and reduce costs while inheriting L1 security. (Zora $ZORA, Manta Network $MANTA, Mantle $MNT, etc.)

DEX – Decentralized exchanges that allow users to trade cryptocurrencies directly without intermediaries. (Jupiter $JUP, MYX Finance $MYX, Aerodrome Finance $AERO, etc.)

POS – Blockchains that use the Proof-of-Stake consensus mechanism, where validators secure the network by staking tokens. (Aptos $APT, Algorand $ALGO, Mina Protocol $MINA, etc.)

Launchpad – Platforms that host token sales and help new projects raise capital and reach early users. (TokenFi $TOKEN, Four $FORM, Pumpfun $PUMP, etc.)

DePIN – Decentralized Physical Infrastructure Networks that tokenize and coordinate real-world resources like computing, connectivity, or hardware. (Render Token $RENDER, Grass $GRASS, Cudis $CUDIS, etc.)

Yield Farming – DeFi strategies where users provide liquidity or stake assets to earn rewards, often in the form of additional tokens. (Resolv $RESOLV, Aave $AAVE, Pendle $PENDLE, etc.)

P2E – Play-to-Earn games where users can earn tokens or assets through gameplay and participation. (Sweat Economy $SWEAT, My Neighbor Alice $ALICE, Fren Pet $FP, etc.)

Data Service – Projects that provide blockchain data, analytics, or infrastructure services to support users and developers. (Bubblemaps $BMT, DexTools $DEXT, Ankr Network $ANKR, etc.)

Blockchain Service – Projects offering tools and solutions that improve blockchain usability, connectivity, or functionality for developers and users. (Bio Protocol $BIO, Sign $SIGN, WalletConnect Network $WCT, etc.)

ZK-Proofs – Projects that use zero-knowledge proof technology to enhance scalability, privacy, and security in blockchain transactions. (ZKsync $ZK, Polyhedra Network $ZKJ, StarkNet $STRK, etc.)

RWA – Real World Asset projects that bring traditional assets like currencies, commodities, or securities onto the blockchain. (Stellar $XLM, Velo $VELO, Injective $INJ, etc.)

Cross-Chain – Projects that enable interoperability and asset transfers between different blockchains. (LayerZero $ZRO, Hyperlane $HYPER, Kava $KAVA, etc.)

LSDfi – Projects built around liquid staking derivatives, enabling users to stake assets while retaining liquidity and earning additional yield. (Obol Collective $OBOL, Lido DAO Token $LDO, Rocket Pool $RPL, etc.)

Rollup – Scaling solutions that bundle multiple transactions off-chain and submit them to a Layer 1 blockchain, improving speed and efficiency. (Fuel Network $FUEL, Taiko $TAIKO, Optimism $OP, etc.)

Metaverse – Projects creating virtual worlds and immersive digital environments with on-chain assets and economies. (ApeCoin $APE, Decentraland $MANA, Victoria VR $VR, etc.)

DeFAI – Projects that merge decentralized finance with artificial intelligence to create automated, AI-driven financial products and services. (BankrCoin $BNKR, Wayfinder $PROMPT, Hive AI $BUZZ, etc.)

Restaking – Protocols that let users reuse staked assets to secure additional networks or services, earning extra rewards. (BounceBit $BB, Renzo $REZ, Babylon $BABY, etc.)

CeFi – Centralized finance platforms where financial services like trading, lending, or custody are managed by centralized entities. (KuCoin Token $KCS, OKB $OKB, Bitget Token $BGB, etc.)

CEX – Centralized exchanges where users trade cryptocurrencies through an intermediary platform. (HTX $HTX, Gate $GT, MX $MX, etc.)

Lending – Protocols that allow users to borrow or lend assets in a decentralized way, often using crypto collateral. (Maker $MKR, Goldfinch $GFI, Spark $SPK, etc.)

PoW – Blockchains that use the Proof-of-Work consensus mechanism, where miners secure the network through computational power. (Ethereum Classic $ETC, Bitcoin SV $BSV, Bitcoin Cash $BCH, etc.)

Payments – Projects focused on enabling fast, low-cost crypto transactions for everyday payments and transfers. (xMoney $UTK, Telcoin $TEL, COTI $COTI, etc.)

AMM – Automated market makers that use liquidity pools instead of order books to enable decentralized trading. (1inch $1INCH, Uniswap $UNI, LFJ Exchange $JOE, etc.)

Perpetuals – Derivatives platforms offering perpetual futures contracts, allowing leveraged trading without expiry dates. (dYdX $DYDX, Aevo $AEVO, Arkham $ARKM, etc.)

Stablecoin Protocol – Projects that issue or manage stablecoins, aiming to maintain price stability against fiat or other assets. (Sky $SKY, Usual $USUAL, Ondo Finance $ONDO, etc.)

Telegram Apps – Projects built as mini-apps or bots inside Telegram, often combining social engagement with crypto features. (Notcoin $NOT, Blum $BLUM, Banana Gun $BANANA, etc.)

AI Framework – Infrastructure projects that provide tools and protocols for building, training, and deploying AI models in decentralized environments. (Olas $OLAS, Swarms $SWARMS, Expand $XZK, etc.)

SocialFi – Projects that merge social networks with decentralized finance, letting users monetize interactions and content. (Towns $TOWNS, Mask Network $MASK, Gravity $G, etc.)

Cloud Services – Decentralized storage and cloud infrastructure projects that allow users to store and access data without relying on centralized providers. (Walrus $WAL, Filecoin $FIL, Arweave $AR, etc.)

Wallets – Applications that let users securely store, send, and receive cryptocurrencies or interact with decentralized apps. (Trust Wallet $TWT, Safe $SAFE, Verasity $VRA, etc.)

BTCfi – Protocols that bring DeFi functionality to Bitcoin, enabling lending, trading, and yield opportunities around BTC. (PumpBTC $PUMP, KernelDAO $KERNEL, Lorenzo Protocol $BANK, etc.)

Analytics – Projects that provide tools for tracking, analyzing, and visualizing blockchain data and on-chain activity. (The Graph $GRT, etc.)

Oracle – Protocols that deliver real-world data to blockchains, enabling smart contracts to interact with external information. (Oraichain $ORAI, UMA $UMA, API3 $API3, etc.)

Currency – Cryptocurrencies primarily designed for payments, transfers, and digital money use cases. (Monero $XMR, Ripple $XRP, BitTorrent $BTT, etc.)

InfoFi – Projects that tokenize information or attention, turning data and user engagement into tradable value. (Kaito $KAITO, etc.)

IOT – Projects that connect blockchain with the Internet of Things, enabling secure data exchange and device interoperability. (IOTA $IOTA, VeChain $VET, Jasmy $JASMY, etc.)

Marketplace – Platforms where users can buy, sell, or trade digital assets such as NFTs, tokens, or in-game items. (SuperRare $RARE, Gala $GALA, Blur $BLUR, etc.)

Derivatives – Protocols that offer synthetic assets or trading products tied to the value of other assets. (KiloEx $KILO, Synthetix Network $SNX, etc.)

Superchain – Networks built by combining multiple blockchains or rollups into a unified ecosystem with shared liquidity and infrastructure. (Worldcoin $WLD, Celo $CELO, Arena-Z $A2Z, etc.)

AI Meme – Meme coins that combine viral culture with artificial intelligence themes or mechanics. (CorgiAI $CORGIAI, Act I: The AI Prophecy $ACT, aixbt by Virtuals $AIXBT, etc.)

Modular – Blockchains that separate core functions like execution, data availability, and consensus into specialized layers for greater scalability and flexibility. (Celestia $TIA, Osmosis $OSMO, Saga $SAGA, etc.)

L0 – Networks that act as base layers connecting multiple blockchains, enabling interoperability and shared security. (Cosmos Hub $ATOM, Venom $VENOM, Polkadot $DOT, etc.)

Digital Identity – Projects that provide decentralized identity solutions, enabling secure authentication and ownership of digital credentials. (Artificial Superintelligence Alliance $FET, Bondex $BDXN, SPACE ID $ID, etc.)

DAO – Decentralized Autonomous Organizations governed by token holders through proposals and on-chain voting. (0x Protocol $ZRX, etc.)

Privacy – Projects focused on enhancing confidentiality of transactions and data through encryption or zero-knowledge technology. (Oasis Network $ROSE, Phala Network $PHA, Aleo $ALEO, etc.)

L3 – Layer 3 solutions built on top of Layer 2 networks, designed to provide specialized scaling or application-specific functionality. (zkLink $ZKL, Xai $XAI, etc.)

VR – Projects creating virtual reality experiences and environments powered by blockchain technology. (Wilder World $WILD, etc.)

SVM – Blockchains and projects built on the Solana Virtual Machine, leveraging Solana’s performance and developer tools. (Solayer $LAYER, Eclipse $ES, SOON $SOON, etc.)

In addition to the categories listed above, there are also less common tags currently on the platform, such as DAG, Robotics, Security, Mobile, DeSci, Name Service, Account Abstraction, Bitcoin Scaling, Collectibles, Education, Gig Economy, Healthcare, Mining Solutions, Accelerator, PolitiFi, Recruitment, Sport, Verification, Wireless Network, zkEVM, and ICM.

Ecosystem Tags

In addition to functional categories, the platform also includes ecosystem tags, which indicate the blockchain environment to which a project belongs. These tags make it easy to identify whether a project is part of a larger network or community, helping users understand its technical foundation and potential integrations.

Available ecosystem tags include: Ethereum Ecosystem, Solana Ecosystem, BNB Ecosystem, Base Ecosystem, Bitcoin Ecosystem, TON Ecosystem, TRON Ecosystem, Hyperliquid Ecosystem, Polygon Ecosystem, Near Ecosystem, SUI Ecosystem, Polkadot Ecosystem, Cosmos Ecosystem, Aptos Ecosystem, Avalanche Ecosystem, Bittensor Ecosystem, Cardano Ecosystem, Dogecoin Ecosystem, NEO Ecosystem, Optimism Ecosystem, StarkNet Ecosystem.

Technical Oriole Insights Tags

Alongside categories and ecosystems, some projects may also carry technical tags specific to Oriole Insights. These indicate the project’s current status on the platform:

- Monitoring – Assigned to projects with low trading volume, limited user activity, and very few predictions. This tag signals a warning stage that may last from several days to a few weeks.

- DELISTED – Applied when a project fails to improve after the monitoring period. While historical stats and past predictions remain visible, no new predictions can be made once a project is delisted.

Rate, Use, Propose and Predict

Explore the new tags and use them to filter projects more efficiently. If you notice incorrect tagging, projects placed in the wrong categories, or missing tags that should be added, let us know in our Discord, either in 🌍┃general or 🤝┃community-suggestions channels.

And as a reminder, Discord has been upgraded with a tiered role structure. At the top is Oriole Insider. This role can be earned by climbing the leaderboard, being an active member, or being invited by an existing Insider.

Becoming an Insider grants access to ORI SQUAD - private threads on listings, testnets, and airdrops, an internal news feed, deep-dive speculation channels, and a closed circle of high-level predictors.

It’s the best resource to stay ahead of market trends and sharpen your edge. The more you participate, the more valuable the loop becomes.

Stay tuned for the next updates — we’re just getting started.