How to Make Money with Cryptocurrency in 2025 (Part 4). Token Sales.

Why Token Sales Still Work in 2025?

Token sales are public offerings where crypto projects sell a portion of their tokens before listing. They raise initial funding, activate the community, and bootstrap liquidity. For participants, it’s a chance to buy early before the token hits the market and potentially profit from the initial listing spike or hold with the best entry price.

Back in the day, token sales were often associated with huge gains. For example, in 2020, MultiversX $EGLD was sold on Binance Launchpad for $0.65 and hit $35 on its listing day — a massive 50x. But in 2025, expectations are more grounded. Moonshots are rare. Still, token sales remain one of the most reliable ways to earn consistent profits, especially if you know where to look.

So why should you care?

Today’s market is more competitive, with new formats (like Binance Wallet IDOs — see Part 3) and dozens of platforms running sales each month. But that’s not a bad thing — more structure and more access mean more opportunities, especially for those who put in the research.

And the best part? Most sales require $100–$200 to join, making them accessible to almost anyone. If you’re serious, we recommend starting with at least $1,000. That gives you flexibility to scale (e.g. five wallets at $200 each) and increases your odds of catching good returns across multiple sales.

In this part, we’ll cover:

- Types of token sale platforms

- Sale mechanics and formats

- What you can do to maximize profits

- How Oriole Insights helps you track sentiment and ROI expectations

Types of Token Sale Platforms in 2025

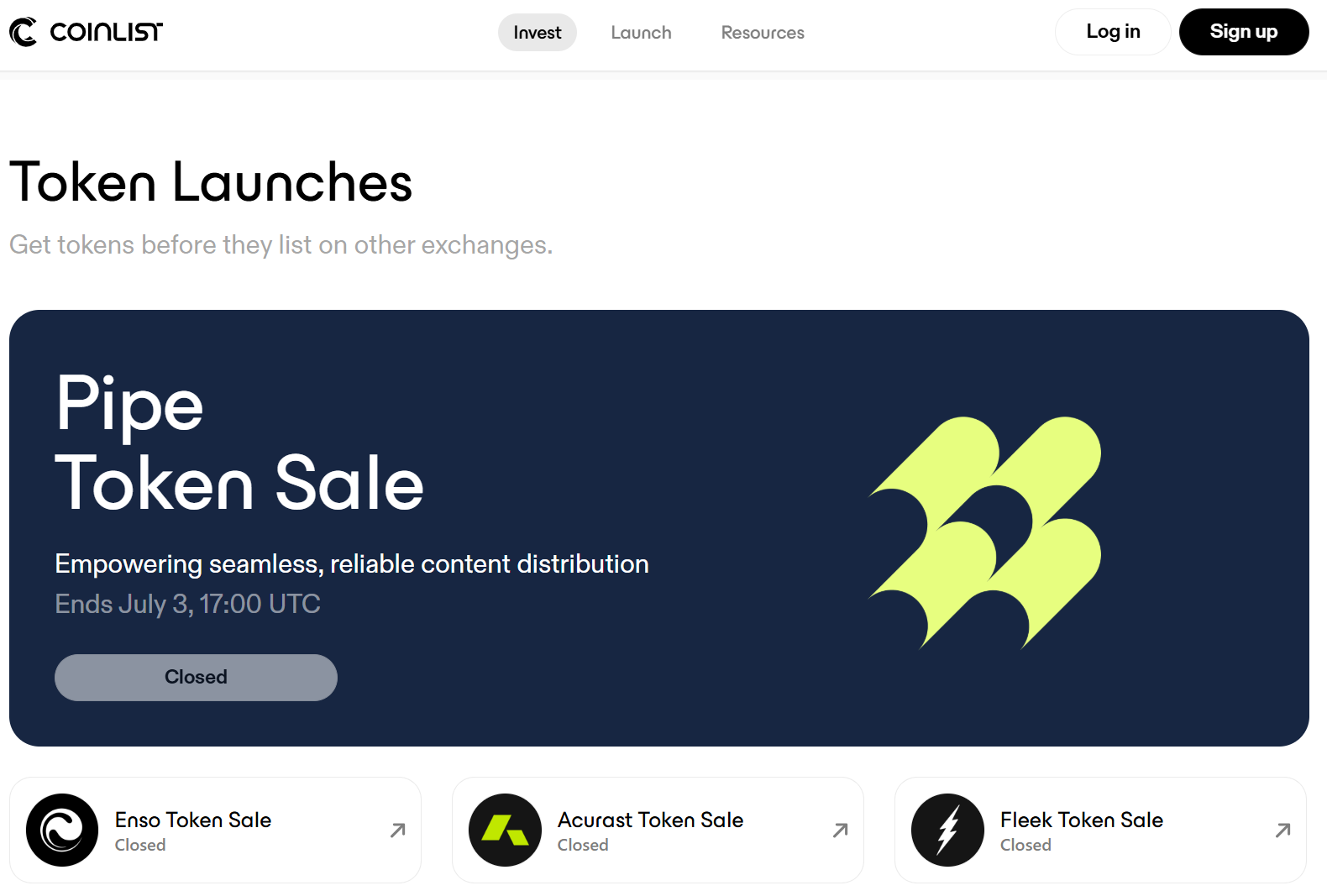

Token sales today extend far beyond CoinList and sales on CEXs. The formats have expanded, participation rules vary, and not every sale requires KYC or centralized approval. Here are the three main types of platforms you should understand before jumping in.

1. Centralized Platforms — KYC, geo-blocks, but strong reputation

This is the classic route: CoinList, Legion, Buildpad, or CEX launchpads like Bybit, KuCoin, MEXC, Gate, etc. To join, you’ll need to complete full KYC and wait for account approval.

In the case of Legion, you’ll also need to connect your wallet, social accounts like X (Twitter) or GitHub, which will form your "Legion Score" that determines whether you're eligible to participate in token sales.

A similar model is used by the newly introduced Capital Launchpad by Kaito AI. It distributes allocations based on a user’s social reputation (on X), token holdings (e.g., $KAITO), and other criteria. Projects define sale terms (valuation, fundraising goal, vesting), and users deposit funds to reserve their spot. Tokens are first distributed in a Preferred Phase, and any remaining are sold via FCFS. Sales like Theoriq $THQ and Espresso $ESP have already taken place through this system, which shares key mechanics with Legion but adds new dimensions like dynamic reallocation and community rebates.

Why it works:

- If a project is launching via the exchange launchpad, there’s almost a 100% chance it’ll also list there.

- Entry capital varies, but some sales start as low as $100–200.

- Drawbacks: KYC is mandatory, some countries are restricted, and running multiple accounts isn’t easy.

Best suited for those who prefer structure, well-known projects, and are willing to go through official procedures.

2. Decentralized Platforms — Web3-style

This includes launchpads like Seedify ($SFUND), TokenFi ($TOKEN), Fjord Foundry, Byreal, and others. Things are more flexible here: connect your wallet, stake or hold the platform’s native token (optional), and you're in.

But watch out for this:

- Some platforms do still require KYC, like Seedify.

- Most require you to stake or hold their native tokens to unlock higher tiers or access. They are using a tiered system — the more $SFUND, $TOKEN, or other native assets you hold or stake, the better your chances of getting a guaranteed allocation.

- Everything happens on-chain — you’ll need additional funds for gas, commissions, and tight attention to sale requirements.

This is for users who are comfortable navigating Web3 independently. And often, these sales happen earlier than on centralized platforms.

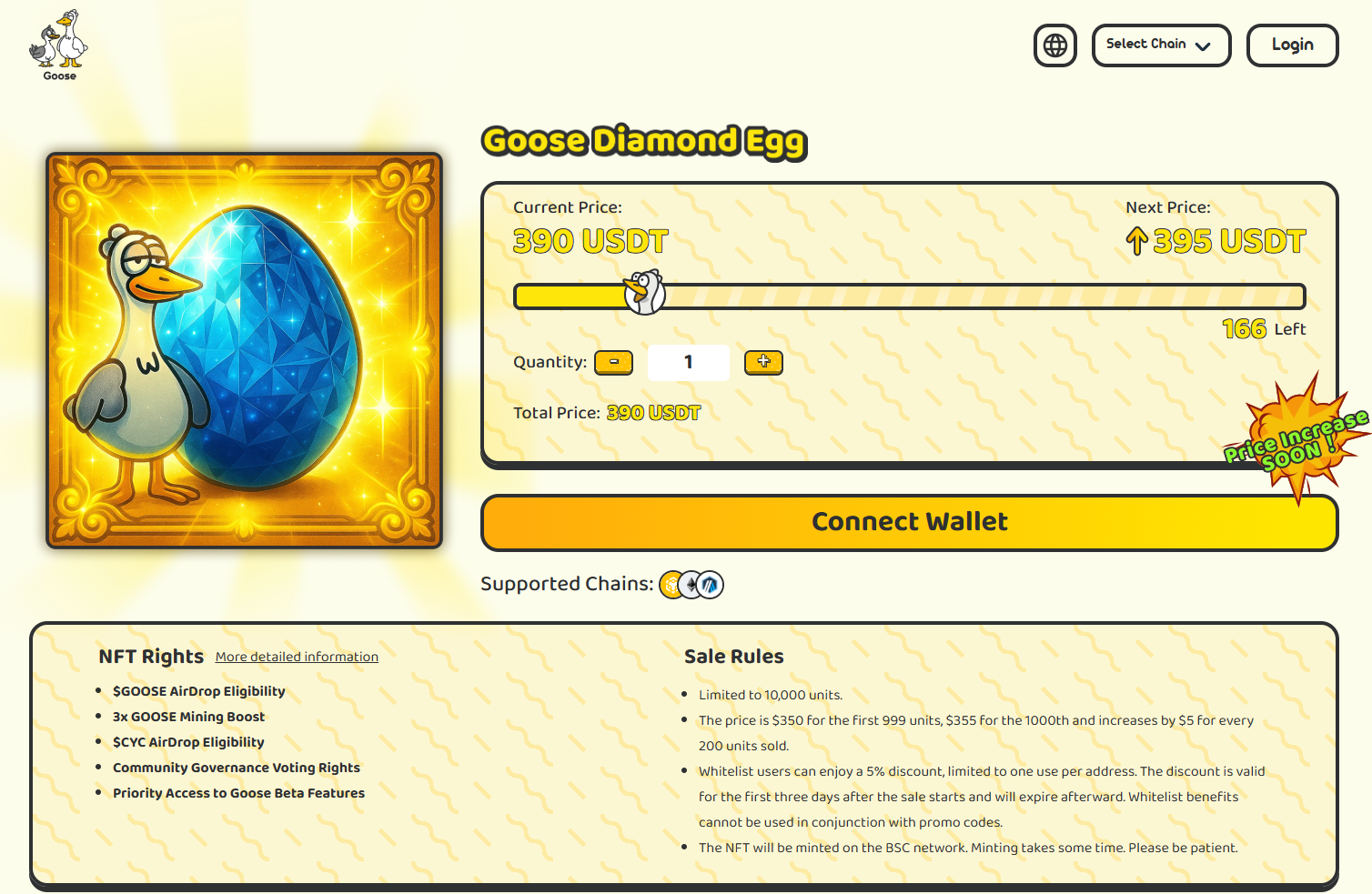

3. Native Sales

No launchpad, no third-party platform. Some teams choose to host their token sale directly on a custom landing page, giving them complete control over the mechanics, design, and reward structure.

A good example is Golden Goose $GOOSE, which launched its Goose Diamond Egg sale on a dedicated website. Instead of a standard token sale, users mint NFTs, and each NFT gives the holder an allocation of $GOOSE and $CYC tokens, along with added perks like governance rights and airdrop eligibility.

In other cases, projects might run a native sale in parallel with a launchpad raise. For example, Pump.fun $PUMP held its token sale both on its site and via third-party partners. Native sales allow them to reward their community directly while still accessing broader audiences via platforms.

Pros and cons:

- Full control — unique terms, bonuses, NFT rewards for participation, and so on.

- But there’s no safety net — no third-party vetting, no platform reputation. You’re trusting the project 100%.

- KYC? Sometimes yes, sometimes no — it’s entirely up to the team.

- Early users of the project — those who joined the Discord early, tested the product/platform, or provided feedback — often get prioritized for whitelist allocations, if the sale has one.

Great for those who want to catch early-stage sales before they go public — but you’ll need to conduct thorough research and double-check everything.

If you choose to go this route, make sure to follow the steps outlined in our Due Diligence article, especially when no third party is involved.

Allocation Mechanics

Token sales employ various methods to determine how allocation is distributed among participants. Some are predictable and stable, others depend on demand and timing. Here are the core formats you need to know in 2025:

1. First Come, First Served (FCFS)

This is the fastest-paced format. Tokens are distributed in real-time to whoever completes the purchase first — once the cap is reached, the sale ends. Timing is everything here: hesitation often means missing out.

Key traits:

- Allocation is not guaranteed.

- Often leads to rushes or heavy traffic at launch time.

- Can favor automated users or those with faster transaction execution.

Best suited for users who are prepared in advance and can act within seconds of launch.

2. Whitelist Allocation

In this model, only pre-approved wallets (usually gathered through allowlists, quests, testnet participation, or community engagement) can participate. Each whitelisted user receives a guaranteed allocation, often fixed or tiered by criteria like community role or early activity.

Key traits:

- You know in advance how much you can buy.

- No competition during the sale itself — once approved, you're in.

- High demand often means limited whitelist spots, so early positioning matters.

Ideal for early supporters, community members, those who actively engage with the project before the sale goes public.

3. Over-subscription Model

Participants commit capital (e.g., $USDT or $BNB) during a fixed period. Once the sale ends, the system calculates final allocations based on total committed funds relative to the token pool.

If total demand exceeds the available tokens, each user receives a proportional share, and the rest of their funds are refunded.

Key traits:

- Allocation scales with the amount of capital you commit.

- The more oversubscribed the sale, the smaller your final share.

- Refunds are automatic, but you may lock funds for hours or days without guaranteed outcome.

This model works well in strong market conditions but may dilute small investors if demand spikes heavily.

4. Fair Auction

Here, participants submit bids specifying the amount they want and the price they're willing to pay. After the bidding window closes, a final clearing price is set, and only bids above or equal to that price receive tokens.

Key traits:

- Introduces a price discovery mechanism that reflects real demand.

- Reduces early mover advantage or insider pricing.

- May result in partial allocation or no allocation at all if your bid is below the clearing price.

More transparent than FCFS or fixed-price formats, but it requires users to carefully assess market sentiment and bid accordingly.

5. Fair Launch

In a fair launch, there are no whitelists, no bidding, and no caps per user - anyone can participate freely, and tokens are distributed based on the share of total contributed funds.

This model emphasizes equality and open access, often attracting wide participation and volatile outcomes. A prominent example is Pump.fun, where every project is launched without gatekeeping, and the price is determined entirely by user demand.

Key traits:

- Open to all - no pre-approval or allowlist needed.

- Can attract both organic and speculative interest.

- Suitable for high-risk, high-reward participants who thrive in unpredictable environments.

Token sale mechanics don’t end with these five. Some platforms use other formats. For example, CoinList’s “filling from the bottom” prioritizes smaller contributions to give retail users a fairer shot and discourages whales.

On top of that, many sales mix multiple formats: combining whitelists with over-subscription, using LBPs (Liquidity Bootstrapping Pools) for dynamic price discovery, or layering in staking, vesting, and community reputation systems.

The key takeaway is understanding how allocation works, even in hybrid setups, which helps you plan, avoid surprises, and focus on the sales that align with your goals and capital.

Token Sale Analytics and Strategy

Token sales can be profitable, but only when they align with your strategy and risk tolerance.

One key question is: are you comfortable locking up part of your capital for months, or even years? If not, look for sales with shorter vesting periods or full unlock at TGE. These deals are becoming more common in 2025, with a growing number of projects offering 100% unlock from day one.

Participation makes additional sense when you're already involved with the project, whether as a testnet user, early supporter, or community contributor. In these cases, not only might you receive a token airdrop, but you're also more likely to get better allocation terms or priority access.

If you're starting, follow active crypto communities. High-quality sales are often broken down in detail on social media, helping you avoid scams and build confidence step by step.

That said, not every token sale leads to meaningful returns. Some may launch at 2x or 3x only to drop in price later due to weak demand, poor tokenomics, or extended vesting cliffs. While 10x+ results still happen, they're rare and losses are just as possible. To build realistic expectations, it helps to study past results using tools like CryptoRank, which tracks launch prices and current trading performance of previous sales.

If you’re planning to get involved, timing and preparation are key. Register early on the platforms listed in this article - many require KYC. For platforms like Legion or Capital Launchpad by Kaito AI, your activity on X (Twitter) matters: it plays a central role in your score and eligibility. To stay ahead of the curve, monitor sales calendars and follow launchpad channels.

Speculation and Multi-Accounting in Token Sales

Two practical levers can significantly improve your results in token sales — one is speculative, the other is structural. Let's break them down.

1. Premarket Speculation and Entry Price Optimization

Sometimes the best opportunities don’t come from participating in the token sale - they go before it. In some cases, tokens begin trading on premarket platforms like Whales Market or even centralized exchanges (Binance, KuCoin, MEXC) before the official TGE.

This early activity allows you to act based on your research.

- If you believe the token is undervalued, premarket listings can provide a chance to accumulate before retail demand kicks in.

- If you think it’s overvalued, you can avoid the public sale altogether or even sell early allocations into the hype, depending on your access.

In other cases, premarket price signals can help you decide tactically:

- If the token trades at just 1.1x–1.2x above the public sale price, it may be more efficient to buy from the market than lock funds in a sale with vesting or delays.

- Or, if you're already participating in the sale and see cheaper prices elsewhere, you can lower your average entry by buying more on the market.

NOT FINANCIAL ADVICE — but premarket trading can be a powerful tool to either hedge your IDO exposure or build a more efficient entry based on how the market values the token ahead of time.

2. Multi-accounting to Scale Allocation

On most platforms, your allocation is capped per account or wallet. So, in token sales with low per-wallet allocation — like Binance Wallet IDOs or sale like $SAHARA (where the average allocation per KYC’d wallet was ~$200) — using multiple eligible accounts can significantly scale your access and profit potential.

We already covered this in detail in Part 3, where we recommended farming Alpha Points across several wallets to increase total allocation and returns.

This is especially relevant when:

- The entry requirements are low (e.g. $200–$300 per account)

- The platform doesn't enforce strict Sybil protection

- Your operational overhead (fees, time, gas) stays manageable

Used smartly, multi-accounting helps you multiply exposure and take full advantage of scalable, low-cap token sales.

How Oriole Insights Can Help You Navigate Token Sales?

Token sales in 2025 are crowded. Some projects can be hidden “gems”, while others are pure hype. Choosing the wrong one can cost you time, opportunity, and money.

Oriole Insights provides a clearer edge by offering a simple yet powerful tool to understand what the broader market expects before the token even lists.

ROI Prediction Markets

Oriole runs prediction markets where users forecast how a token will perform post-listing, based on its TGE price. Will it be 1.2x? 2x? Dump below the public sale price? You can track real-time sentiment from predictors and gauge whether it aligns with your expectations.

This isn’t just “guessing the pump.” It’s a crowd-powered sentiment layer that helps you:

- Identify overhyped or underhyped sales before joining

- Decide whether to participate at all

- Adjust your sizing based on the expected ROI range

- Spot premarket mispricings and hedge accordingly

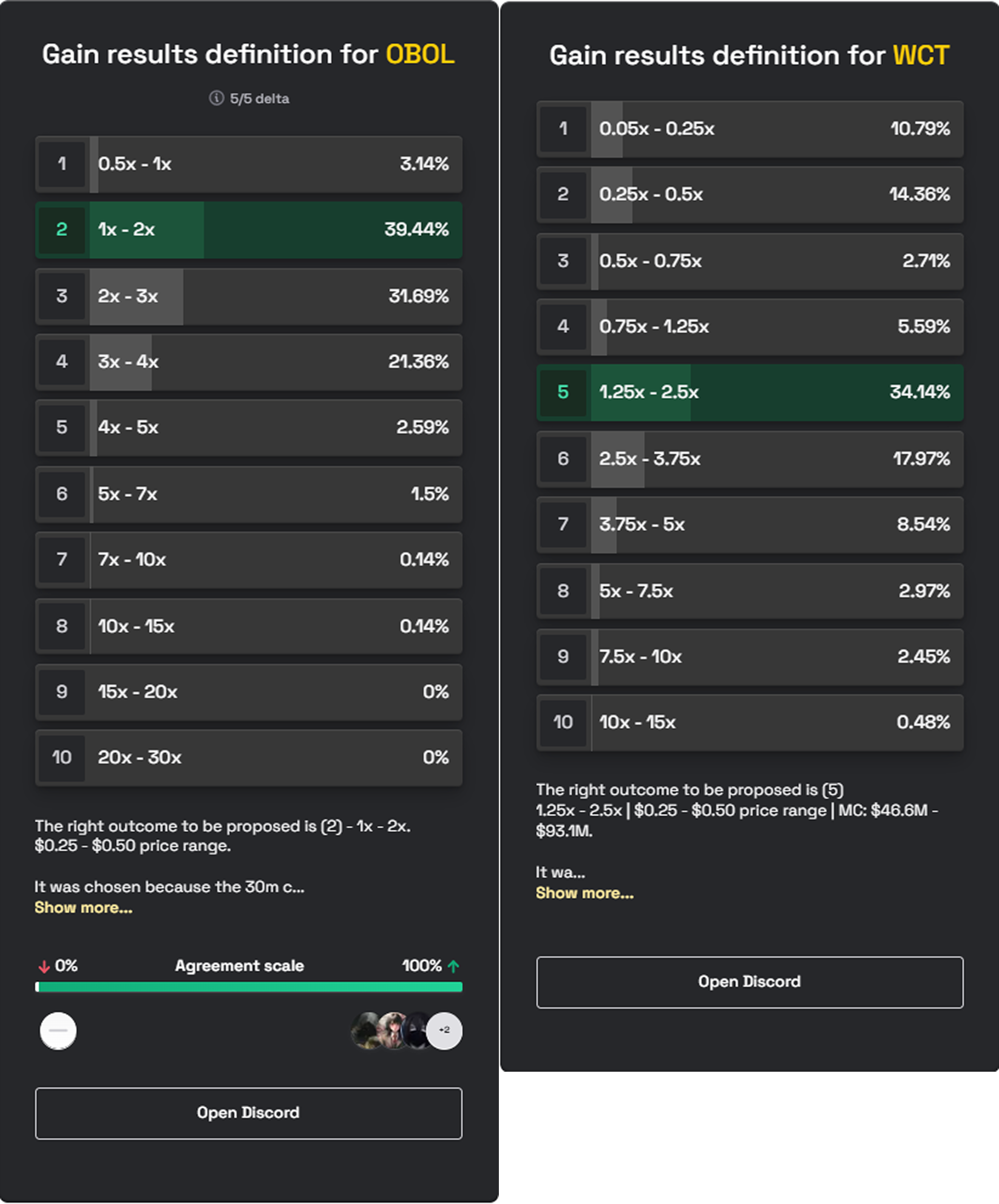

Let’s look at two examples:

- $WCT: Voted most likely to land in the “1.25x–2.5x” range. Final listing: ~$0.345 (vs $0.20 sale price). Crowd nailed it.

- $OBOL: Voted most likely to land in the “1x-2x” range. Listed: ~$0.43 (vs $0.25 sale price). Again, the most voted range was correct.

Why it matters for token sales

When capital or allocation is limited, knowing where not to participate is just as important as spotting good ones. In short, if you’re doing token sales in 2025, Oriole can help you:

- Filter noise in early-stage sales

- Size your positions based on expected performance

- Track sentiment trends before the rest of the market catches up

It’s not magic. But it’s a useful compass — especially when the hype machine is in overdrive.

Token Sales in 2025 Are Still Worth It — If You Play It Right

Participating in token sales in 2025 is accessible even with modest capital — you can start with as little as $100-$200. However, realistically, we recommend allocating at least $1,000 if you're serious about it. This provides you with more room to scale across multiple accounts, absorb volatility, and make participation worthwhile.

Remember: your funds will often be locked for days, weeks, or even months, and if the project underperforms at TGE, you may have to realize a loss or hold through drawdown.

Not every sale will moon!

If you’re new to token sales, begin with centralized platforms like CoinList or exchange launchpads. They’re safer, easier to navigate, and reduce the risk of scams. As you gain experience, you can explore decentralized platforms and native sales — but only after doing proper due diligence.

Ultimately, don’t chase sales blindly. Start by evaluating the project. Ask yourself: “Do I actually want to invest in this?” Only after that should you decide how to participate and whether the token sale terms are favorable.

And before you ape — always check ROI Prediction Markets on Oriole Insights. Many projects that are conducting token sales now have active markets where users predict expected ROI post-listing. It’s a simple way to gauge sentiment and avoid getting caught in low-performance deals.

In the next article, Part 5, we’ll dive into the rise of Attention Markets: how they work, what drives traction, and how to position yourself to earn from early momentum and user engagement.