How to Make Money with Cryptocurrency in 2025 (Part 3). Binance Wallet IDOs

Why Binance Wallet IDOs Matter in 2025

Among all the ways to earn in crypto through token sales, Binance Wallet IDOs stand out in 2025 for one reason: they reward consistency. While the final upside may feel like a quick flip, getting there takes a daily grind of Alpha Point farming.

This isn’t a one-click registration. To have a real shot at allocations or random drops, users need to maintain steady, on-platform activity - holding funds, trading select pairs, or the best approach would be to do both.

This model suits users with $2,000+ in flexible capital - enough to participate without relying on loans or sacrificing yield elsewhere. It also covers the daily costs of “spin” trades (buys/sells in the Alpha token section) needed to farm points efficiently. This is less about luck and more about sticking to a repeatable routine for a few weeks at a time.

We’ve carved out a dedicated chapter for this format because Binance Wallet IDOs follow a completely different logic than most other token sales.

In Part 4, we’ll explore other token sales formats — CoinList, Legion, direct sales, etc. But for now, this system deserves its own breakdown.

Let’s dig into how it works — and whether it’s worth your time.

![]()

![]() Recent Binance Wallet IDO Performances (Gross / Net Profit)

Recent Binance Wallet IDO Performances (Gross / Net Profit)

Project | 3 BNB (1 acc) | 6 BNB (2 accs) | 9 BNB (3 accs) | 12 BNB (4 accs) | 15 BNB (5 accs) |

Reddio $RDO | $75 / $60 | $150 / $120 | $225 / $180 | $300 / $240 | $375 / $300 |

DAOBase $BEE | $50 / $35 | $100 / $70 | $150 / $105 | $200 / $140 | $250 / $175 |

MEET48 $IDOL | $110 / $90 | $220 / $180 | $330 / $270 | $440 / $360 | $550 / $450 |

Elderglade $ELDE | $80 / $60 | $160 / $120 | $240 / $180 | $320 / $240 | $400 / $300 |

Privasea AI $PRAI | $100 / $80 | $200 / $160 | $300 / $240 | $400 / $320 | $500 / $400 |

What Are Binance Wallet IDOs and How Do They Work?

What’s an IDO anyway?

An IDO (Initial DEX Offering) is a token sale that lets users buy tokens before they hit the open market. The difference lies in the platform.

While most IDOs happen on decentralized launchpads, Binance Wallet IDOs run on a centralized engine with a Web3 twist - using Binance Wallet to manage on-chain participation.

It’s a hybrid model: centralized access + decentralized interface.

Evolution of Binance Wallet IDOs

Binance Wallet IDOs launched in early 2025 as a streamlined way to participate in exclusive token sales directly via Binance’s Web3 Wallet. Initially, the entry requirements were minimal: Binance account (KYC), Binance Wallet, and up to 3 BNB for token subscription.

No farming, no score thresholds, if you showed up, you could participate. The first 11 sales were straightforward and profitable, with most tokens offering strong day-one returns (e.g., $BANK: 11.4x, $HYPER: 25.6x ATH).

But as the format gained traction, Binance made changes to tighten eligibility and drive deeper ecosystem engagement.

April 2025 — Alpha Points Introduced

Starting with the 12th sale ($OKZOO), Binance rolled out the Alpha Points system (which we will break down later) - a new metric that determines whether users can participate in upcoming IDOs.

Alpha Points turned the sale model into a loyalty funnel pushing users to stay active across the Binance ecosystem. Holding funds, rotating capital, and engaging daily became necessary just to stay eligible.

May 2025 — Alpha Point Burn Mechanism

On May 13, Binance introduced a new mechanic: Alpha Points now get burned when you either participate in an IDO or receive an airdrop.

This change made the system more dynamic - Alpha Points are no longer permanent. To remain eligible for future sales and benefits, users must continue farming points consistently.

In short, what started as a simple launchpad has evolved into a full-stack marketing engine, rewarding users who play by Binance’s rules across CEX, Wallet, and chain.

Allocation Mechanics

Binance Wallet IDOs typically use a pro-rata oversubscription model:

- Users can subscribe with up to 3 BNB during the TGE (Token Generation Event);

- Your allocation is proportional to your contribution versus the total BNB pool.

- Any unused BNB is automatically refunded.

Participation Requirements

- KYC-verified Binance account;

- Binance Wallet connected to that account;

- BNB balance (max 3 per sale);

- Minimum number of Alpha Points (varies by sale).

Despite the increased friction, Binance Wallet IDOs remain attractive because the returns speak for themselves. Every single project launched via this method in 2025 (so far) was profitable at TGE. The model has proven to be one of the few consistent win-rate opportunities in these market conditions, provided you do the prep work.

How to Farm Alpha Points Effectively?

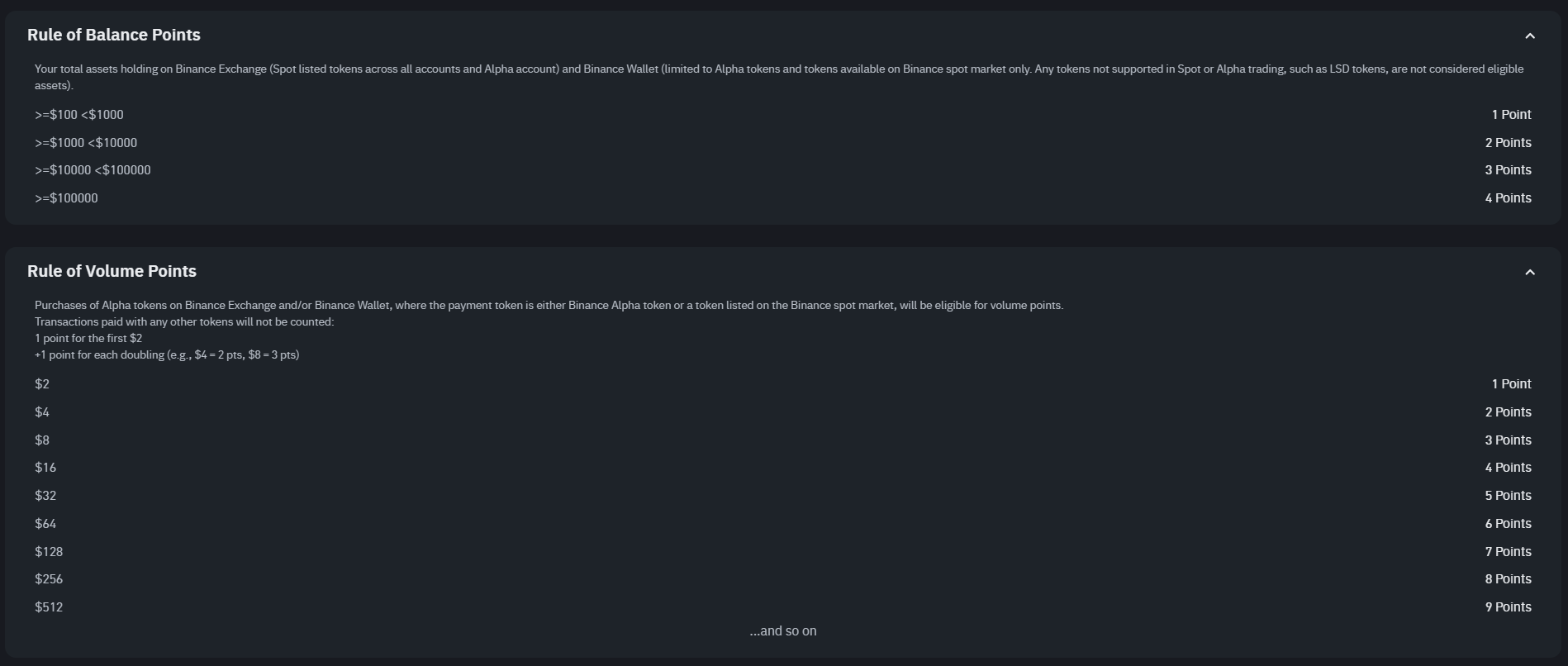

As has been written before and repeatedly, to qualify for Binance Wallet IDOs, you need Alpha Points. They’re earned daily based on your token holdings and trading activity in the Binance ecosystem.

You can track your current Alpha Point balance and check rules directly in the Binance app. Go to the Home tab → tap More under Services → search for Alpha Events.

There are two sources of Alpha Points:

- Balance farming — holding funds across your Binance spot account, Web3 wallet, or Alpha Earn.

- Volume farming — buying/selling Alpha tokens on Binance or in the Wallet.

For volume farming, the Binance system tracks your total purchase amount, not your remaining balance. This means you can buy and instantly sell and still receive points for the full trade volume. But to farm efficiently, you need a plan — not just random swaps.

Let’s say you’re working with $1,000. The most effective strategy is to farm on the BNB Chain, where trading Alpha tokens earns 2x points compared to other networks. Here’s how to optimize it:

- Choose high-liquidity BSC Alpha tokens — to minimize slippage and ensure smooth execution.

- Perform multiple fast swaps (buy/sell) — only volume matters, not the holding duration.

- Avoid holding tokens — most are volatile and if the price drops it will reduce the net profit.

With $1,000, performing two quick BNB Chain swaps per day can earn you around 12 Alpha Points daily from volume. Add another 2 points from balance farming, and you're looking at 14 points per day — enough to reach 210+ points in just 14–15 days.

For context: the recent NodeOps ($NODE) IDO required 208+ Alpha Points just to qualify. If you’re farming 6–10 points per day, reaching this threshold takes 3 to 5 weeks — and that’s assuming daily commitment and no downtime.

Alpha Point farming is a daily grind — especially since points get burned after each IDO or airdrop claim. Staying eligible long term means rotating capital daily and not sitting idle.

We recommend this model to users who can commit at least $2,000 in flexible capital. This level gives you enough room to farm points aggressively, absorb temporary losses, and still profit from the upside of token sales or exclusive airdrops.

How to Decide Whether an IDO Is Worth It?

Alpha Points are a limited resource, and not every sale deserves your allocation. After joining an IDO, points are burned, so it makes sense to treat this like resource management, not automatic farming.

If the project performs poorly or offers only minor gains, it might not cover your Alpha Points farming costs (fees and trading losses).

Before spending Alpha Points on a new IDO, evaluate whether it's worth it. Here’s how to assess the opportunity using publicly available data:

- The project itself — Use due diligence frameworks, such as the one we wrote earlier, "How to Conduct Due Diligence on Crypto Projects," to check team background, funding, roadmap, token utility, etc.

- Past IDOs as reference — Compare tokenomics, sale structure, and listing performance. If a similar setup led to a weak listing or poor post-IDO performance, treat this as a signal.

- Premarket — If the token is already trading on premarkets like KuCoin, MEXC, Bitget or other OTC platforms, check the price. If it trades just ~1.2x–2x above IDO price, it might not be worth spending points, especially if stronger IDOs may launch soon.

This kind of pre-analysis protects your Alpha Point budget and improves your shot at higher ROI entries.

How to get $BNB for IDO?

Once you've farmed enough Alpha Points to qualify for the next Binance Wallet IDO, the next bottleneck is simple: you’ll need up to 3 $BNB to participate.

To track upcoming IDOs, you can either go to the Alpha Events section and tap “TGE” — this will automatically redirect you to the correct page inside the Binance Web3 Wallet, or open the Wallet manually, go to the Discover tab, and then select the Exclusive TGE section.

If you don’t already hold $BNB, you generally have two options:

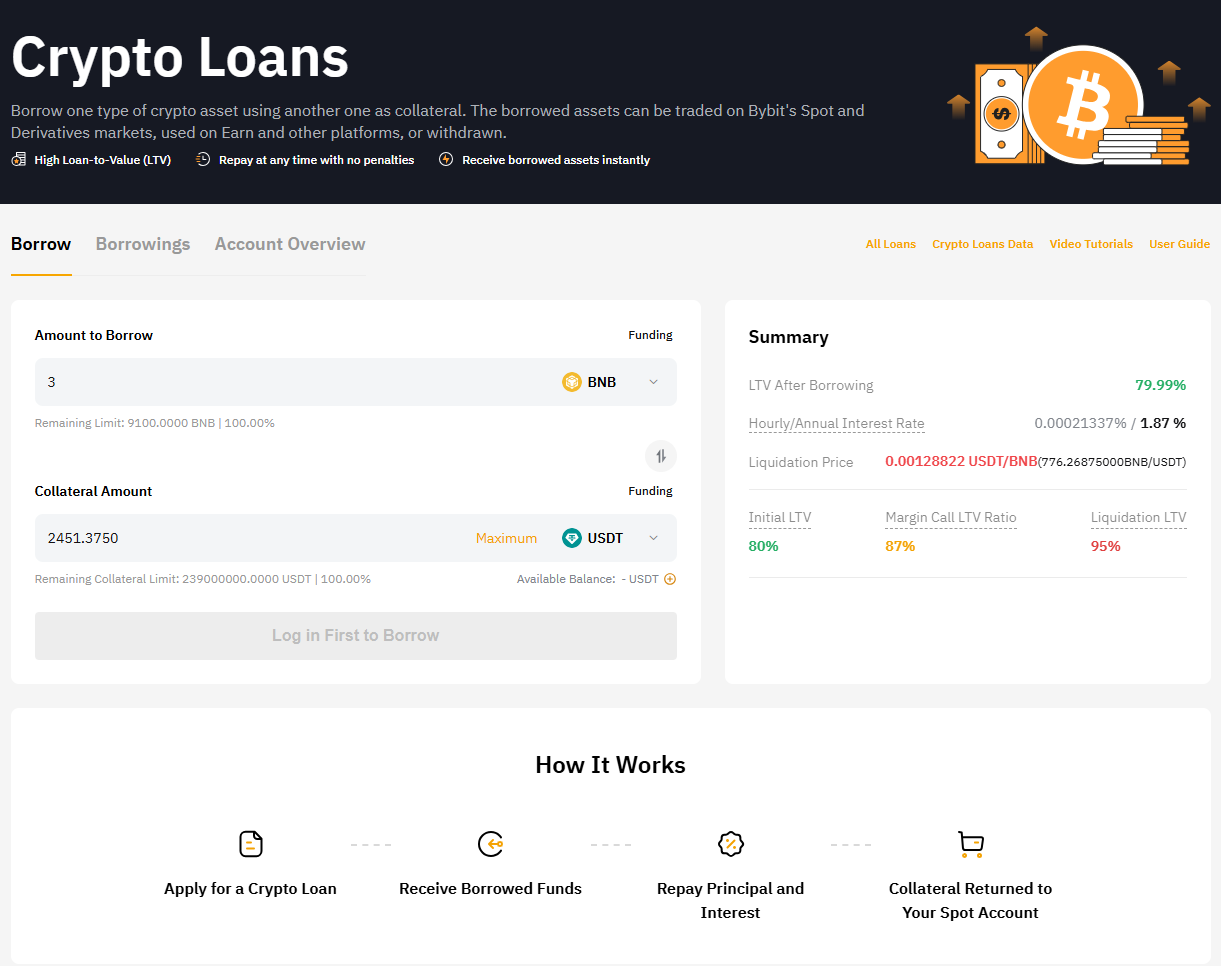

1. Borrow $BNB (Bybit, OKX, etc.)

You can take a short-term loan via spot margin or lending services on platforms like Bybit, OKX.

Things to watch out for:

- Interest Rates: Loans typically come with hourly/daily interest. Double-check your expected ROI before proceeding.

- Liquidation Risk: If you're borrowing against collateral, ensure your LTV (Loan-to-Value) stays within a safe range.

- Time Management: Plan to repay the loan shortly after the token sale listing to minimize fees.

This approach is useful if you want to stay fully liquid and avoid converting stablecoins or other positions.

2. Buy $BNB and Hedge with a Short

If you prefer to avoid borrowing risk, you can buy $BNB on spot, and open a short position on BNB futures with a similar amount.

This creates a neutral market exposure, where gains or losses on BNB price movements are offset between spot and futures.

Hedging tips:

- Use a limit order for both spot and futures around the same price point (spot and perp prices often differ slightly).

- If the price difference is within $1–2, it’s usually fine to execute immediately.

- We recommend a leverage of no more than 3-4x when opening the short to avoid unnecessary liquidation risk.

This setup lets you meet the $BNB subscription requirement while protecting your capital from price volatility.

Final Thoughts

If you have at least $1,000 in flexible capital, Binance Wallet IDOs remain one of the most consistent and profitable token sale formats in 2025. The requirements are clear, the Alpha Point system is transparent, and the day-one performance of every IDO this year has delivered profit.

The trade-off? It’s more about consistency than effort. Once your routine is in place, daily Alpha Point farming can take less than 10 minutes a day. Just don’t forget to monitor official Binance Wallet channels for IDO announcements and updated entry thresholds - being early and informed is still key.

In the next article, Part 4 of this series we’ll move beyond Binance to explore other active token sales: CoinList, Legion, direct sales, etc. Stay tuned.