How to Make Money with Cryptocurrency in 2025 (Part 2). Profiting from Exchange Marketing Campaigns

Centralized exchange (CEX) campaigns remain one of the most consistent ways to earn in crypto, especially for users with limited capital but enough free time to monitor and act fast. In many cases, you can get started with just $100, and some campaigns don’t require any capital at all.

Why do exchanges run these campaigns?

It’s simple: to attract users, boost trading activity, and build hype around new tokens or features. These promotions help exchanges grow volume, gain market share, and drive users into specific behaviors like staking, referrals, or spot trading. In return, they reward participants with $USDT, project tokens or exclusive rewards.

In 2025, campaign formats vary from simple airdrop quests to structured points systems and volume-based prize pools. Some are easy to complete, others require you to move fast and outcompete thousands of users within hours/minutes of launch. Execution and timing matter.

In this guide, we’ll cover:

- What core types of CEX campaigns exist today;

- Who they’re best suited for, and which are worth your time;

- How to prioritize your focus depending on time vs. capital;

- Tactical tips to maximize results and avoid common traps.

If you treat it seriously, CEX campaigns offer one of the lowest-risk earning strategies for everyday users.

How to Track?

Staying ahead in exchange campaigns isn’t just about speed - it’s about knowing where to look.In many cases, the best opportunities only appear if you’re actively tracking official sources. Here’s where to focus:

1. Official Announcements Pages

Every major exchange has a dedicated announcements hub where new campaigns go live first.

Examples: Binance, Bybit, KuCoin.

Check them daily - these pages usually update before anything hits social media.

2. Event Dashboards & Campaign Hubs

Some platforms (like MEXC) provide a full campaign calendar with live and upcoming events.

It’s the easiest way to see what’s active, what’s ending soon, and where your time is best spent.

3. Exchange X (Twitter) Feeds with Notifications On

It might feel like digital noise, but turning on notifications for the exchanges you use is worth it. You’ll often catch limited-time campaigns here, especially when the platform pushes ecosystem tokens or celebrates milestones.

Build your tracking system. Don’t rely on word of mouth or Telegram threads alone - by the time the crowd reacts, the best campaigns may already be full.

Core Types of CEX Campaigns

CEX marketing campaigns in 2025 fall into a few major buckets. Each has its own mechanics, expected effort, and capital requirements. Below is a breakdown of the most common types - how they work and what users can expect.

1. Task & Quiz ($0-Cost Entry)

These campaigns are perfect for users who don’t want to invest or simply can’t at the moment but still want to earn on the side. They’re simple to complete and often involve tasks like watching a short video or answering quiz questions. For beginners or multitaskers, they’re a low-effort way to build up capital from scratch.

While these may look like educational tools at first glance, they are, in fact, a form of marketing campaign often organized in collaboration with token projects that want visibility. The rewards you receive usually come directly in the form of the featured project’s tokens.

A clear example is Binance’s “Learn & Earn” program. In June 2025, it promoted WalletConnect $WCT, where users were rewarded after passing a short quiz based on project mechanics. This helps the project onboard users, promote awareness, and gives participants a small token bonus in return.

To join, you’ll need a KYC-verified Binance account and quick execution - rewards are limited and distributed on a first-come, first-served basis. Once the token pool is gone, the campaign is closed.

These campaigns rarely pay big (usually a few dollars per quiz), but for users with spare time and access to multiple eligible identities (while avoiding obvious linking), they can become an additional farming method. Just remember: Binance disqualifies bulk-registered or connected accounts, so don’t be reckless.

This is a textbook case of a zero-capital, low-effort campaign, but one where speed and timing matter.

2. Deposit, Trade & Earn ($100–$500)

This type of campaign requires users to deposit or trade a specific token to unlock eligibility for a share of the prize pool. It's not zero-cost, but still very accessible - you’re not spending money, just allocating it temporarily to fulfill the requirements.

Importantly, many campaigns separate eligibility conditions for new and existing users. Newcomers typically face lower thresholds (smaller deposits or trades) and can receive fixed rewards or priority access. Existing users, in contrast, are often required to generate higher volume to earn proportional rewards from larger shared pools.

A typical setup involves depositing a small amount (e.g. 100 $USDT) or making trades worth 500–1000 $USDT. Rewards are often split pro-rata based on your trading volume compared to the total volume of all participants.

Examples:

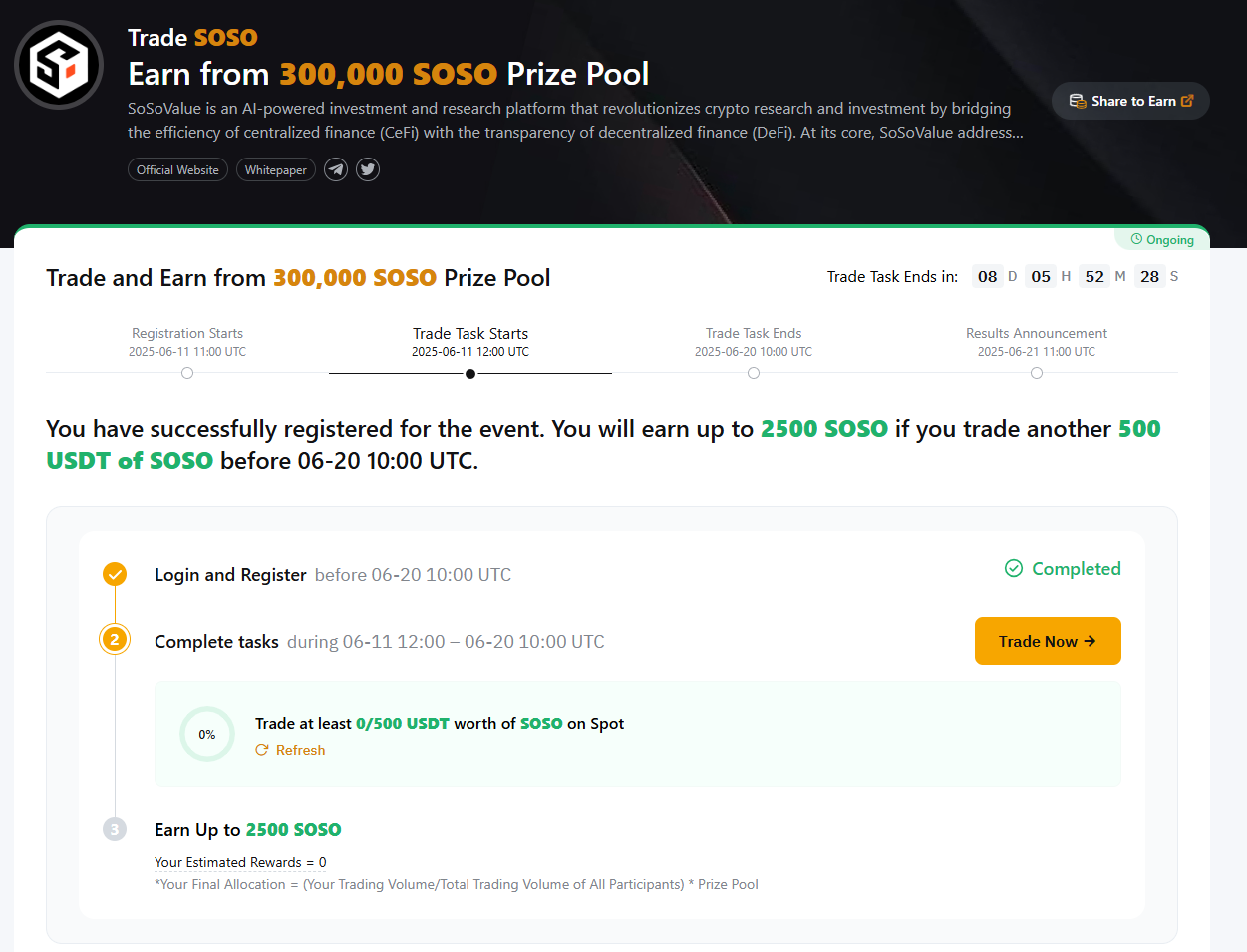

- Bybit’s Token Splash campaign for $SOSO: Users who registered and traded at least $500 worth of $SOSO were eligible to earn up to 2500 $SOSO from a 300,000-token pool. Rewards are calculated based on your share of the overall trading volume.

- MEXC’s YieldNest ($YND) campaign: A layered structure that explicitly differentiated between new and existing users.

– New users could deposit from $100 or trade just $100 worth of $YND (spot) or $500 (futures) to claim fixed bonuses of $20–$40, distributed to the first 1000 participants.

– Existing users had to trade significantly larger volumes - $2,000+ on spot or $20,000+ on futures to claim a share of respective $5,000 and $50,000 pools, with rewards calculated based on each trader’s share of the total volume.

- KuCoin’s Resolv ($RESOLV) listing event: New users who deposited 5,000 $RESOLV and traded at least $500 during the promo period shared 10,000 $USDT. A separate 12,000 $USDT pool was available for all users trading more than $1,000 worth of $RESOLV.

This category suits users with mid-level capital ($100–$500). It's relatively low-risk - you're not buying random tokens blindly, just operating your capital in time-limited promotions that can boost your balance.

3. Lottery-Style ($100-$1000)

This type of campaign is built around luck rather than guaranteed rewards. Even if users complete all the required tasks such as trading, registering, or collecting in-game items — the final prize is determined by a random draw or selection. It’s a classic case of “fulfill the conditions, then hope for the best.”

Unlike fixed or pro-rata rewards, lottery campaigns usually offer limited prizes (e.g. NFT boxes, exclusive tokens, merch, or $USDT) to a small group of winners. These events are often gamified, designed to drive engagement and volume while keeping participants excited through the chance to win.

Examples:

- Bybit’s Tokyo Beast Lucky Draw: Participants earned lucky draw entries by completing tasks such as making a $100+ deposit, referring friends to the Telegram Mini App, trading a minimum of $100 on spot or $500 on futures, and more. Each task gave a set number of draw tickets. These were then used to spin a prize wheel, offering airdrops (10–10,000 $TGT), real items (DJI Pocket, iPhone 16 Pro, gold bar), or NOTHING. The more tickets you collected, the more spins you had.

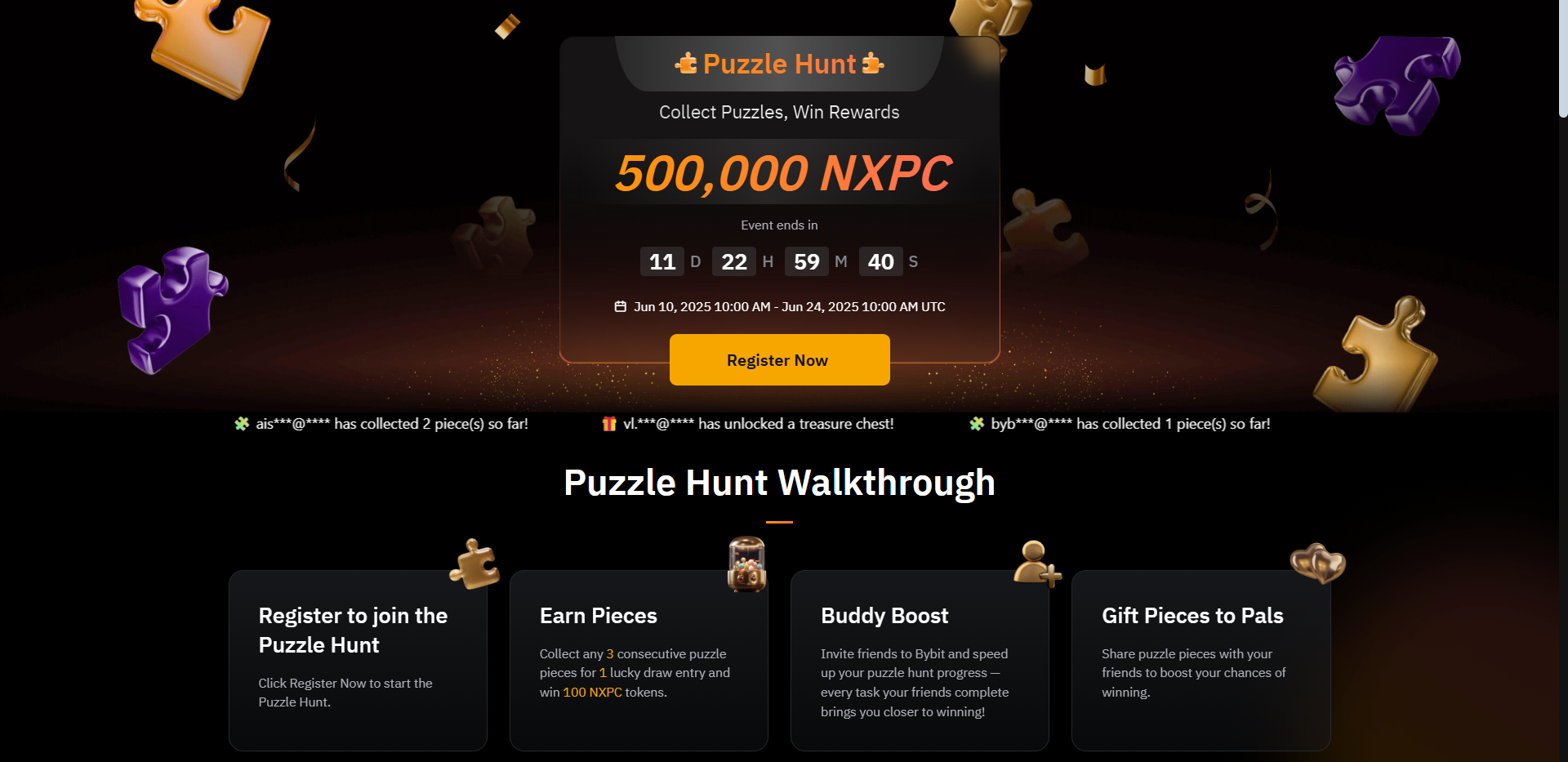

- Bybit’s Puzzle Hunt: This campaign combined collection mechanics with a lucky draw. Users completed tasks to earn puzzle pieces, such as: daily check-ins, depositing or trading $NXPC, social tasks, etc. Collecting any 3 consecutive puzzle pieces gave one entry to the grand draw. Rewards included 100 $NXPC tokens (first-come, first-served) and a large prize pool of 500,000 $NXPC.

These campaigns are ideal for users who enjoy gamified experiences and don’t mind taking calculated risks with low effort. While there’s no guaranteed return, the potential upside can sometimes justify the small capital or time spent especially if the campaign coincides with projects you already trade.

Want to add a quick farming twist? Participate with multiple accounts or identities at your own risk, but be aware that bulk registrations or repeated patterns are often flagged — lottery slots are limited, and platforms do enforce anti-cheat rules.

4.Trading Competitions ($1,000+)

Trading competitions are high-stakes campaigns where users compete based on trading volume to win a share of a large prize pool. Unlike fixed or pro-rata reward systems, these events typically reward only the top performers -usually the top 50 or 100 traders - with better rankings earning higher payouts.

These campaigns require a significant capital commitment and sustained activity. Participants are often ranked on a public leaderboard, which updates in real time. While the reward pools can be large (e.g., $15,000 or more), only the most active traders with consistent volume stand a real chance of earning meaningful returns.

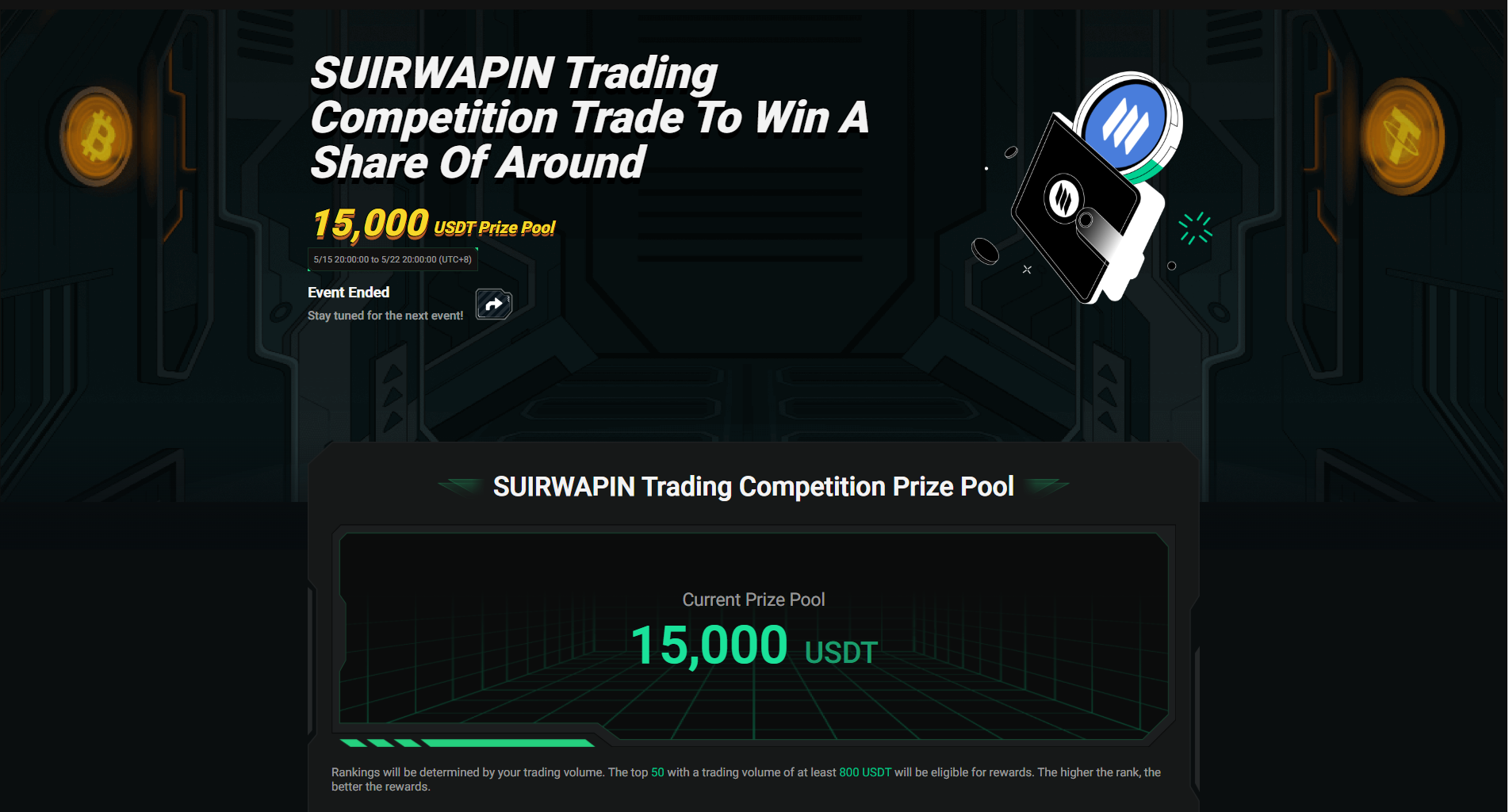

A prime example is KuCoin’s SUIRWAPIN Trading Competition, where users had to trade at least $800 to qualify. The top 50 traders by volume earned a share of the $15,000 prize pool, with top traders reaching six-figure trading volumes (e.g., $100,000+).

Risks & Notes:

- These campaigns involve higher capital exposure and potentially longer trade durations.

- Market movements and trading fees can impact profitability especially for users aiming to “volume farm” their way into the top tier.

- Participants must avoid suspicious trading practices (e.g., wash trading or bot abuse).

This format is best suited for experienced traders with a larger bankroll and a tolerance for volatility. While the competition is fierce, those who can optimize their execution and manage volume efficiently may walk away with a sizeable reward.

5. Binance Wallet IDOs ($300–$1000+)

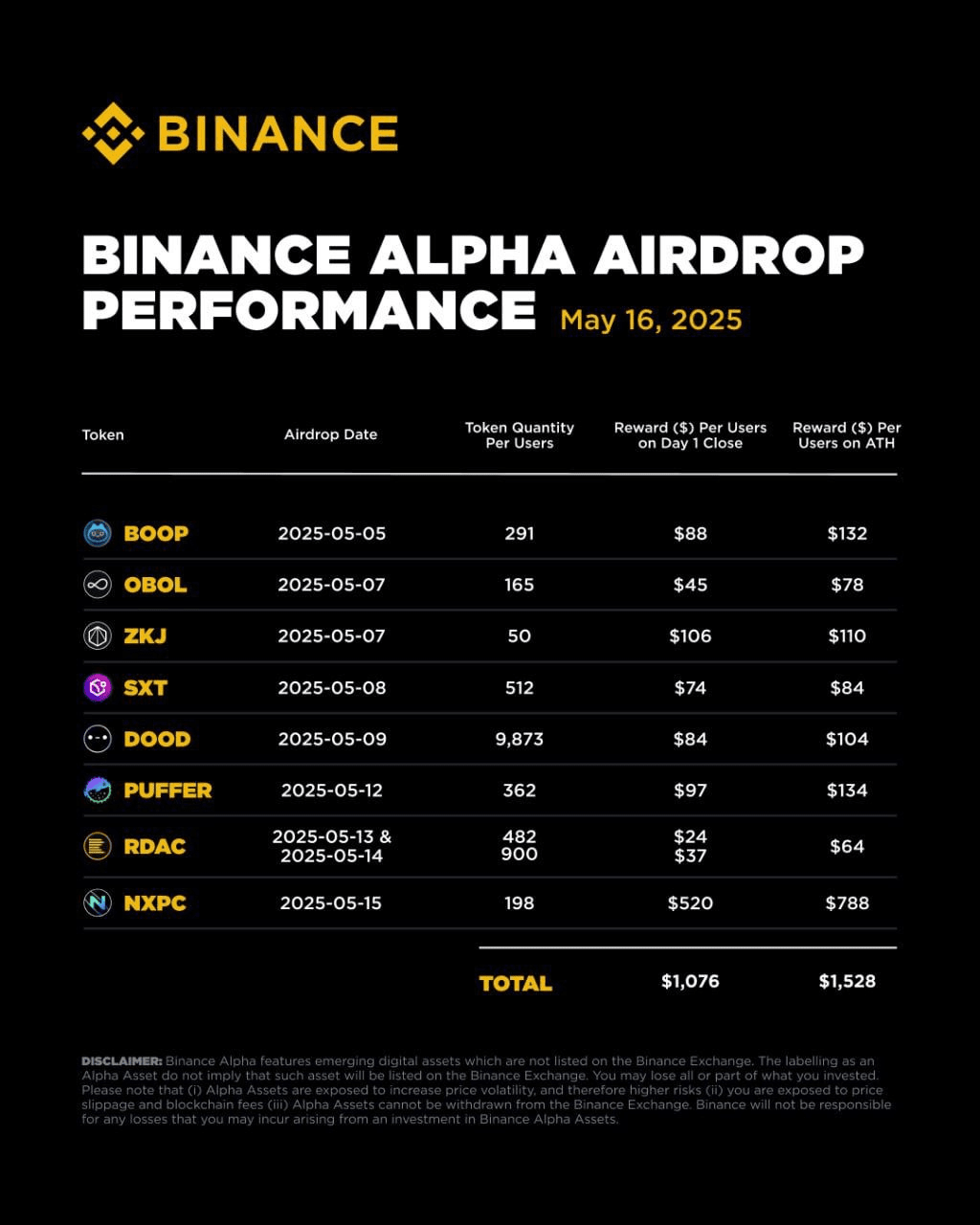

Starting in 2025, Binance launched a new system around token sales via its Web3 wallet, but under the hood, this is one of the most effective ongoing marketing campaigns Binance has ever built. At the center of it is Alpha Points— a persistent scoring mechanism that rewards ongoing participation across Binance products.

The logic is simple: if you want a shot at future token sales, random airdrops, or early access perks, you need to farm Alpha Points consistently. And to do that, you’ll need to interact with multiple parts of Binance’s ecosystem on a near-daily basis.

You earn Alpha Points in three main ways:

- Holding funds in your Binance Wallet or centralized account — incentivizing users to keep capital on Binance;

- Trading selected “Alpha tokens”, which rotates regularly — helping boost volume for promoted pairs;

- Using BNB Chain — giving a 2x multiplier on earned points and driving activity to Binance’s native chain.

What makes this campaign unique is how deeply it integrates all of Binance’s services: centralized exchange, Web3 wallet, selected markets, and on-chain activity.

Why farm Alpha Points?

- They unlock eligibility for Wallet-based IDO launches, often with either guaranteed or lottery-style allocation;

- They grant access to randomized airdrops, whitelists, and priority bonuses;

- They may influence your score in Binance’s rotating internal reward systems, which shift monthly.

For Binance, this system encourages deeper platform engagement and longer capital retention. For users, it creates a gamified, multi-layered way to build access — but only if you're consistent.

This is not a passive earn-and-done setup. It’s a live loyalty engine, and if you’re farming campaigns actively in 2025, Alpha Points are one of the few efforts worth stacking.

A complete breakdown of how Binance Wallet-based token sales work, including how Alpha Points fit into the system, will follow in Part 3.

Choose Your Campaign Style

Each of these campaign types offers a different balance between effort, capital, and expected return. Here’s a quick breakdown to help you navigate:

Task & Quiz Campaigns - perfect for low-effort side income. If you’re just starting out or farming across accounts, this is your zero-risk entry point.

Deposit & Trade Campaigns - ideal for users with $100–$500 to allocate. You’re not buying speculative coins blindly just operating your capital smartly to earn structured rewards. Risk is minimal, and returns can be meaningful if timed well.

Lottery-Style Campaigns - gamified and fun, but results vary wildly. You might win an iPhone or you might get nothing. Worth a try if the effort is light or if the required trades align with your existing activity.

Trading Competitions - high reward, but also high burn rate. You’ll need thousands in trading volume and a solid strategy to compete. Great for whales, pros, or volume-maximizers, but not beginner-friendly.

Alpha Points (Binance Wallet) – high-effort, long-cycle campaigns best suited for users who actively rotate capital. If you already trade on Binance, hold funds on-platform, and don’t mind chasing multipliers, Alpha Points unlock access to future IDOs, random airdrops, and internal rewards. Treat it like a loyalty farming system, not a one-off event.

Stack these campaign types based on your capital and time. Use quizzes and low-cost events to farm entry capital. Reinvest that into medium-tier deposit campaigns, and once you’re confident (and cashed up), scale up to leaderboard events.

In 2025, CEX campaigns reward not just how much you invest - but how strategically you act.

Practical Tips

Exchange-based reward campaigns are one of the easiest entry points for users with small to mid-sized capital. But farming them effectively requires more than just clicking buttons it’s about choosing the right campaigns and avoiding common traps.

Before joining:

- Check if your country is eligible. Many platforms exclude users from specific jurisdictions including some EU regions even if registration is possible.

- Avoid futures trading if you’re a beginner. Don’t risk liquidation just to farm $20. Stick to spot trading tasks unless you fully understand leverage and margin.

- Plan your referral strategy. Most campaigns include referral tasks, but your pool of friends and relatives is limited. Don’t waste them on low-reward events - save referrals for campaigns where the bonus per invite is meaningful or where completing a small number of invites unlocks a significant payout.

- Don’t keep all your funds on one exchange/account. Platform risks (suspensions, bans, KYC issues) are real. Diversify across accounts and wallets.

- Expect to complete KYC everywhere. Most campaigns, even airdrops and quizzes, require verified accounts to receive rewards.

- Don’t overtrade just to farm volume. When a task says “trade $1,000,” don’t try to time the market or scalp it. Execute the volume, close the loop, and move on. Attempting to speculate during tasks can lead to slippage, fees, and unwanted losses.

Want to maximize profit across campaigns? Multis are a must.

Let’s be real - 1 account is fine, but 10 accounts are better. If your capital is limited, spinning up multiple accounts (with VPNs, clean browser setups, and KYC on family/friends where possible) can massively increase your output.

Campaigns that give rewards to the first 1000 participants, or those with limited per-user caps, are where multis shine. Same goes for referral challenges - you can’t refer yourself without extra accounts.

Of course, be smart: exchanges actively monitor for patterns, so spread your activity, avoid overlap, and don’t recycle wallets.

When to participate:

- The reward pool is large relative to required effort;

- The campaign is underexposed - not blasted all over crypto X (Twitter);

- You’ve done the math and your personal odds look favorable.

When to skip:

- The pool is tiny and everyone’s talking about it;

- The campaign is over-complicated or diluted across too many users;

- You’d be spending real risk capital just to chase minimal upside.

The goal isn’t to grind every campaign - it’s to farm selectively, efficiently, and with long-term capital growth in mind.

Final Thoughts

CEX campaigns remain one of the most stable and scalable ways to earn in crypto especially if you're starting with limited capital but have time, curiosity, and a system. Whether it's watching a short video for $3 or trading $500 to unlock a pro-rata reward, these opportunities let users convert effort into capital without going all-in.

But not all campaigns are worth your time. The key is to filter fast: focus on those with asymmetric upside and low commitment. Build your capital from task-based campaigns, reinvest it in medium-tier trading events, and if you’ve got the skill and bankroll - climb the ladder to pro-level competitions.

As we move deeper into 2025, CEX campaigns are evolving — but the core remains the same: act early, act smart, and act selectively.

Next up in Part 3 — Binance Wallet Token Sales: how Alpha Points shape access, what mechanics to watch, and how to position yourself for the most promising IDOs of 2025. Stay tuned!