What is the Real Value of BNB?

TL;DR

BNB isn’t just a token - it’s a yield engine. Over the years, holding it has proven more profitable than trading it.

- BNB price grew from $0.50 to $1,300+ (2,600× gain).

- $4.73B total distributed through Launchpools, HODLerDrops, and Megadrops.

- Average holder earned $300+ per 1 BNB in rewards.

- BNB’s deflationary model keeps reducing supply (60M+ burned, 100M target).

- Top campaigns: $TLM, $USUAL, $SAGA, $MOVE, $PENGU - each paid out $140–185M+.

- A $1,000 investment since 2020 would now be worth over $361,000+ - purely from reinvested rewards.

The actual value of BNB isn’t just in its price, but in how much it pays those who hold it.

Real yield from compounding shows that just holding BNB can outperform many DeFi strategies.

Introduction

The goal of this article is to determine not how BNB has performed as a speculative asset, but more importantly, how much passive profit it can generate when treated as a yield-bearing token (considering compounding from fixing all token drops into BNB).

History shows that simply holding BNB is not just about price appreciation; the token has also delivered risk-free rewards through Binance products designed to incentivize long-term holders.

What is BNB?

BNB is the native token of the Binance ecosystem, used for trading fee discounts, payments, and powering transactions on the Binance Smart Chain. Beyond its utility, BNB has evolved into an asset that consistently generates rewards and benefits for its hodlers.

By allocating BNB into Binance products such as Simple Earn, holders automatically become eligible for various token distributions from upcoming projects. These distributions occur through multiple structured programs, each with its own specific mechanics.

What is Simple Earn?

Simple Earn is Binance’s flagship product, allowing users to deposit BNB (and other assets) into either flexible or locked savings accounts. Flexible terms allow users to withdraw at any time, while locked terms offer higher yields for committing tokens over a specified period.

For BNB, the flexible Simple Earn APR typically ranges between 0.03% and 0.06%, while Locked BNB products in Simple Earn usually provide an APR of 0.25% to 0.5%, depending on the duration and market conditions.

Importantly for BNB holders, keeping tokens in Simple Earn does more than generate base yield; it also guarantees eligibility for key reward programs, such as Binance HODLer Airdrops and Megadrops. In practice, Simple Earn serves as the gateway that converts BNB into a productive, income-generating asset.

Reward Mechanisms for BNB Holders

- HODLer Airdrop – Rewards distributed to all accounts holding BNB in Simple Earn during official snapshot periods. Allocations are proportional to holdings and require no extra action, making this the most passive way to earn.

- Launchpool – A structured farming campaign where users stake BNB into a pool for a limited time to earn tokens from new projects. Rewards accumulate daily, and BNB is unlocked once the campaign ends.

- Megadrop – The newest distribution format, combining loyalty from holding BNB in Simple Earn with interactive tasks in the Binance Web3 Wallet. Allocations are boosted by “loyalty multipliers,” rewarding consistent long-term holders. Megadrop is designed as a more dynamic, gamified evolution of the HODLerdrop.

BNB Performance and Key Stats

Before diving into the mechanics of BNB reward programs, it’s essential to look at the broader picture of BNB as an asset.

Its value has been shaped not only by exchange utility and demand, but also by a built-in deflationary burn mechanism, a strong record of price performance across cycles, and a central role in Binance’s distribution programs. Together, these factors explain why BNB remains viewed as both a growth asset and a consistent source of passive yield.

BNB Burn Mechanism

One of BNB’s most distinctive features is its deflationary design. The long-term goal is to gradually reduce the total circulating supply until it reaches 100 million BNB. To achieve this, Binance has introduced several complementary burn mechanisms:

- Auto-Burn – Conducted quarterly, this mechanism automatically calculates the amount of BNB to be burned based on supply and market activity.

- Real-Time Burn (from fees) – A portion of transaction fees on Binance Spot, Margin, and Futures markets is continuously used to buy back and burn BNB in real time.

- BEP-95 – Implemented on BNB Smart Chain, this mechanism burns a share of gas fees paid by users, making the burn rate more closely tied to on-chain activity.

- Pioneer Burn Program

As of the 32nd BNB Burn (July 2025), Binance burned 1,595,599 BNB, leaving about 139.3 million BNB in circulation.

Since launch, the supply has already been reduced from the initial 200 million BNB to the current 139 million, meaning over 60 million BNB have been permanently burned. The next burn to be conducted on the 1st of November 2025.

This marks significant progress toward the ultimate target of 100 million, with nearly two-thirds of the journey already completed.

Over time, the scale of each burn has grown significantly: while the earliest burns were under 1 million BNB, later events have exceeded 3.6 million BNB in a single quarter. This dynamic highlights both the expansion of Binance’s ecosystem and the consistency of its deflationary model.

BNB Price Performance Across Cycles

BNB’s price history reflects the ups and downs of the wider crypto market, but with one consistent pattern — each cycle has reinforced its role as one of the strongest-performing assets.

- Early Growth (2017–2019): After listing on Binance at around $0.50, BNB quickly proved its value as the backbone of the exchange ecosystem. Within two years it was trading in the double digits, establishing itself far beyond its launch price.

- Bull Market 2021: During the explosive rally across crypto, BNB surged to an all-time high of $691.77 on Binance, securing a spot among the top three cryptocurrencies by market capitalization.

- Bear Market 2022–2023: While broader markets saw deep corrections, BNB traded in the range of $183.40 to $350. Despite the drawdown, it consistently held a multi-billion-dollar valuation and remained a top-ranked token, showing resilience compared to most altcoins.

- Current Cycle 2025: In the latest rally, BNB not only recovered but set a new record, climbing above $1,349.99 to mark its highest level yet. This milestone highlights both the enduring demand for BNB and the continued expansion of its ecosystem.

From under a dollar at launch to over a thousand today, BNB’s multi-cycle performance underscores why it is treated as a long-term core holding by many investors.

Binance Launchpool, Hodlerdrop, and Megadrop Track Record

Beyond price action and the burn mechanism, BNB’s strength is also reflected in its role as the entry ticket to Binance’s distribution programs. To date, BNB has enabled access to:

- 70 Launchpool campaigns

- 4 Megadrop events

This track record shows the scale of opportunities made available exclusively to BNB holders, confirming why the token is seen as more than just an exchange coin.

In the sections below, we will explore the data behind these programs in detail, from the value Binance has distributed over time to the projects that delivered the most significant returns, and how different sell-or-hold strategies would have impacted outcomes. This retrospective analysis will provide a clearer view of the real value of BNB as a yield-generating asset.

How Much USD Binance Has Given Back to BNB Holders?

Over the past five years, Binance has distributed billions of dollars in rewards to long-term BNB holders through its ecosystem programs.

These campaigns represent Binance’s way of returning value to its community, rewarding users not for trading activity, but for simply holding and participating in the network’s growth.

The data below illustrates how these rewards have evolved across market cycles, from the early dominance of Launchpool to the emergence of HODLer and Megadrop incentives, showing not only how much BNB holders earned but also when Binance’s reward engine was most active.

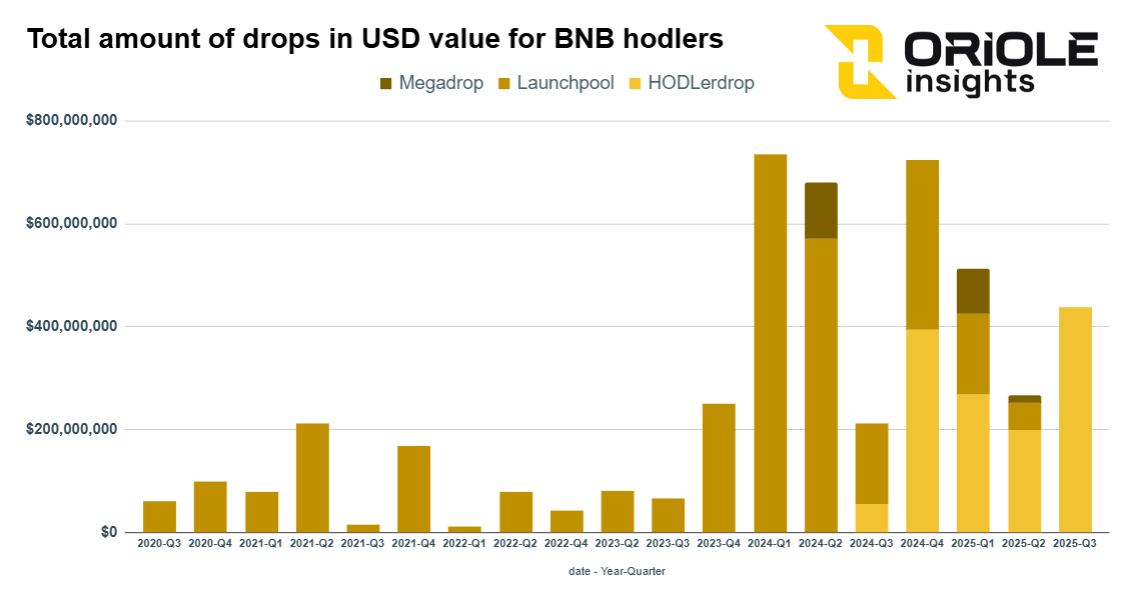

The chart shows a steady buildup through 2020–2021, a lull during the 2022–2023 bear cycle (with no sharp spikes), and then a step change from late 2023.

Launchpool dominates the early waves, with the most significant surges in Q1 2024 and Q4 2024. From 2024 onward, you can also see the mix broaden: HODLerdrops begin to contribute materially (peaking through 2025), while Megadrop appears in late 2024 and early 2025 as a smaller but growing slice.

Overall, post-2023 distributions become larger and more frequent, while those from 2022–2023 remain comparatively flat.

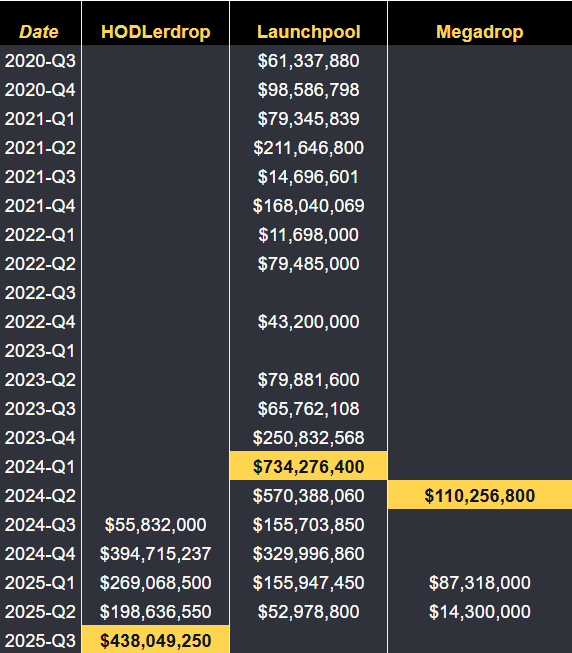

Detailed Breakdown by Program (2020–2025)

Across all programs, Binance has distributed $4,731,981,020 to BNB holders.

Cumulative Rewards by Program:

- Launchpool: $3,163,804,683 (primary driver of total value)

- HODLerdrop: $1,356,301,536 (most significant growth in 2024–2025)

- Megadrop: $211,874,800 (newest, smaller but rising)

Top quarters by program:

- Launchpool: Q1 2024 – $734,276,400.

- HODLerdrop: Q3 2025 – $438,049,250.

- Megadrop: Q4 2024 – $110,256,800.

Bottom line: Launchpool contributed the majority of value since 2020, while HODLerdrops became the dominant driver from 2024 to 2025. Megadrop remains smaller in scale but adds a new growth layer to Binance’s reward ecosystem.

Which Projects Delivered the Biggest Payouts to BNB Holders?

While the total distribution numbers show how much Binance has given back overall, it’s equally important to look at which individual projects generated the largest rewards for BNB holders.

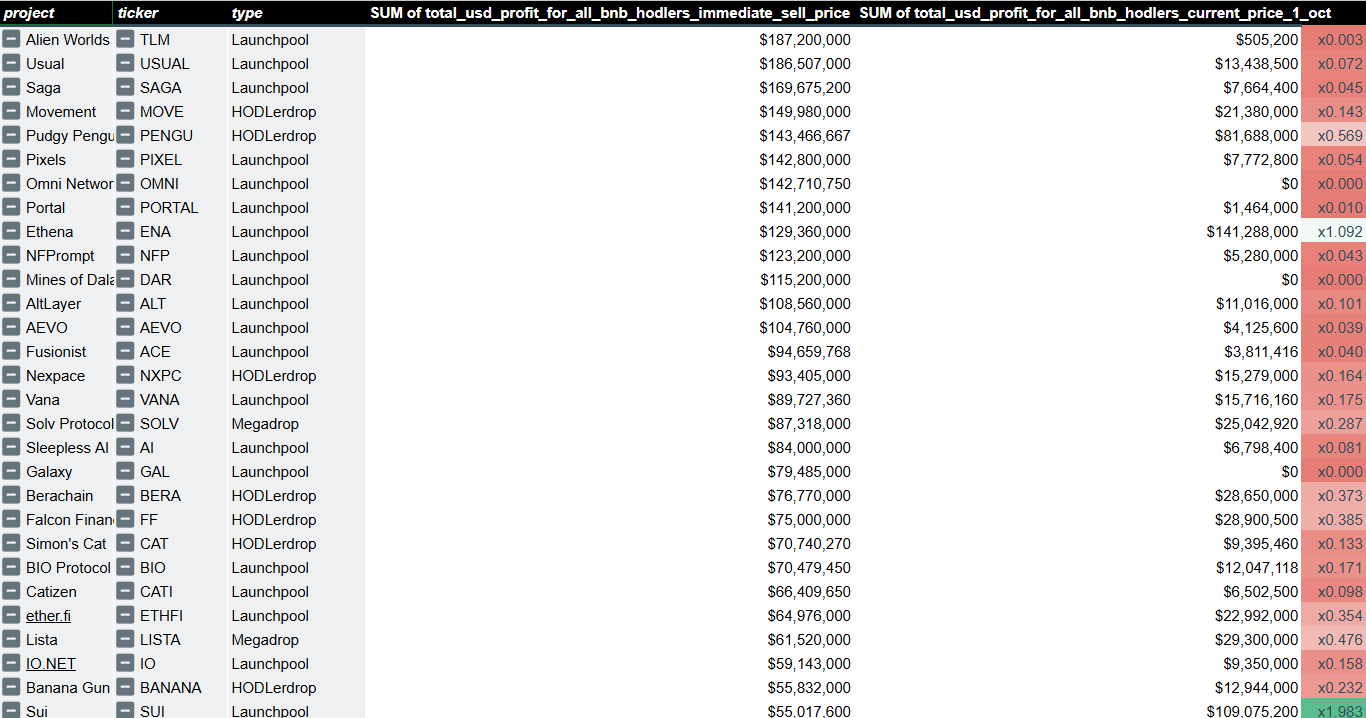

The table below compares two key metrics:

- Total USD profit at the time of listing (assuming all distributed tokens were sold during the first tradable moments), and

- Current value as of October 1, 2025, reflecting how these tokens have performed over time.

This allows us to see both the initial realized value and the current holding value - effectively, how much those rewards are worth now if holders had chosen not to sell.

BNB Holder Rewards by Project

Across all programs, $TLM, $USUAL, $SAGA, $MOVE and $PENGU delivered the biggest USD payouts at launch, with profits exceeding $140–185+ million each.

However, when comparing the total USD profit pools between the listing day and October 1, 2025, only two tokens - $ENA and $SUI maintained or increased their total value, meaning holders of these tokens would have earned more (or roughly the same) by holding rather than selling early.

For most other projects, including major ones like $TLM, $ALT, $PENGU, $PORTAL, $PIXEL, $USUAL, and $NFP, the total value of distributed tokens has dropped sharply — in many cases retaining less than 5–10% of their initial distribution value.

This indicates that while Binance reward campaigns generate substantial short-term profits, selling early remains the most efficient strategy for maximizing realized returns.

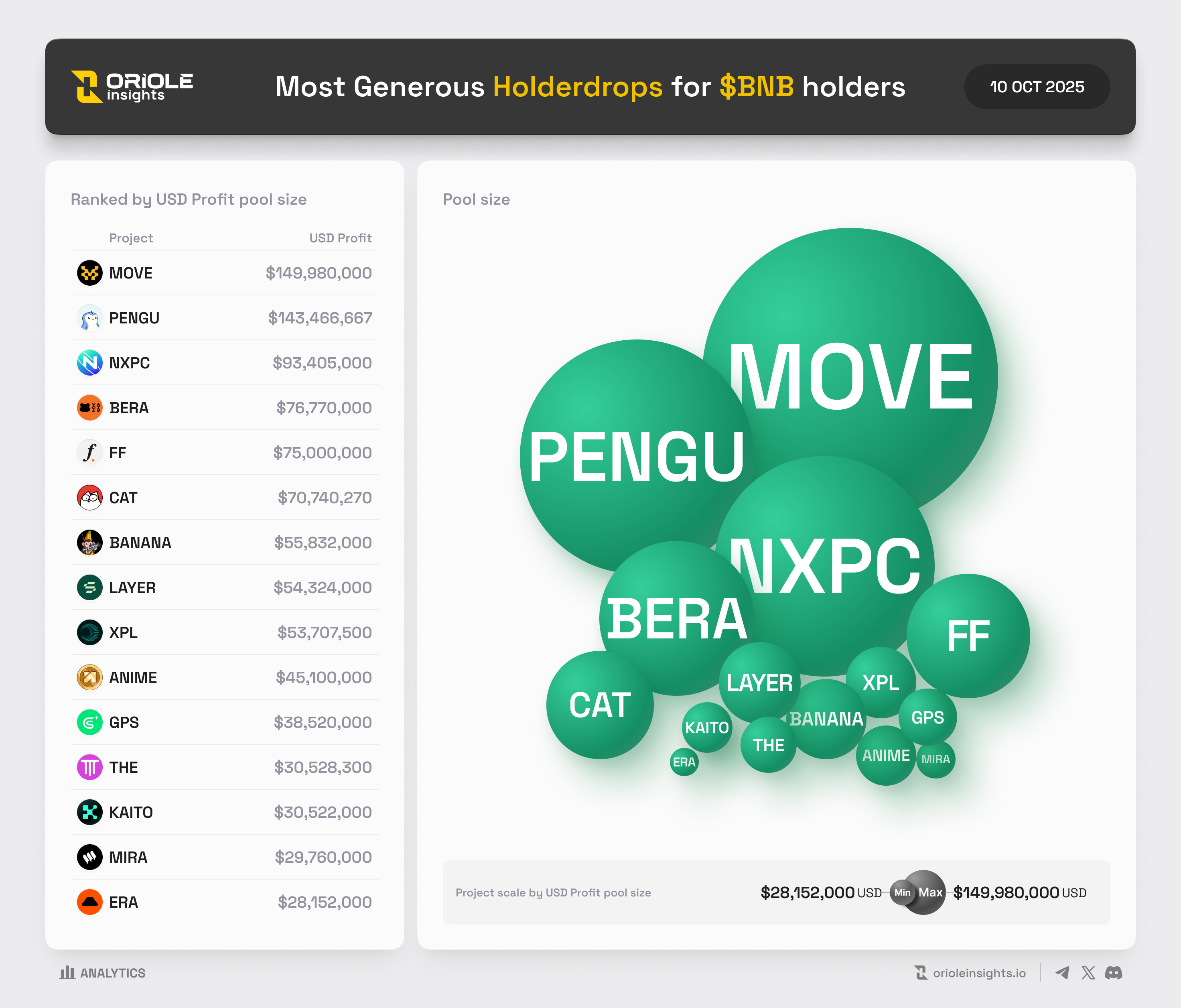

Most Generous HODLer Airdrops

The visualization above highlights the largest HODLer reward pools, led by Movement ($MOVE), Pudgy Penguins ($PENGU), and Nexpase ($NXPC), which together account for over $386 million in total payouts.

These campaigns confirm the growing impact of HODLer-based distributions, which have evolved into one of Binance’s most consistent loyalty mechanisms during 2024–2025, rewarding long-term holders and reinforcing the value of sustained participation in the ecosystem.

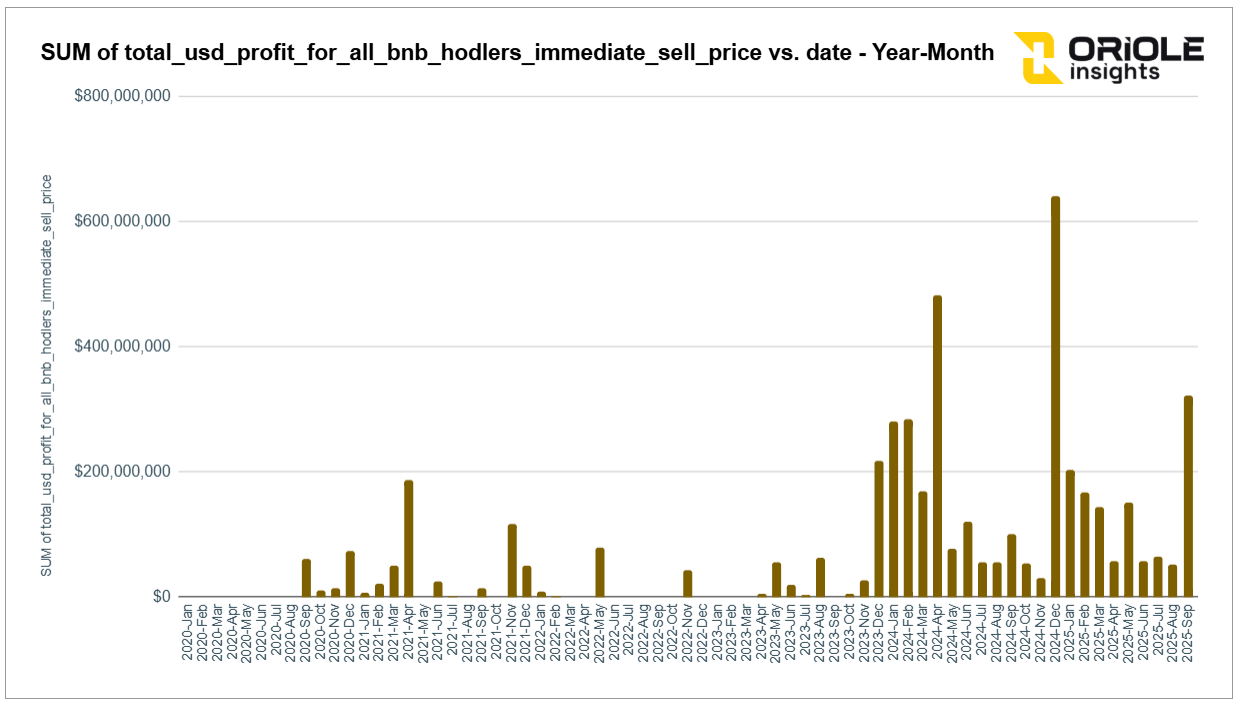

Monthly Distribution of Total Profit for BNB Holders

Before diving into the retrospective profit scenarios per 1 BNB, let’s first take a look at the monthly distribution of total profit - how much BNB holders could have earned if all distributed tokens were sold immediately after becoming tradable.

The chart illustrates the sharp growth in total profits over time, with a notable increase in distributions starting from December 2023. The three most profitable months are December 2024, April 2024, and September 2025.

With the latter marking one of the strongest payout periods to date, happening just last month, it confirms that Binance’s reward flow remains highly active.

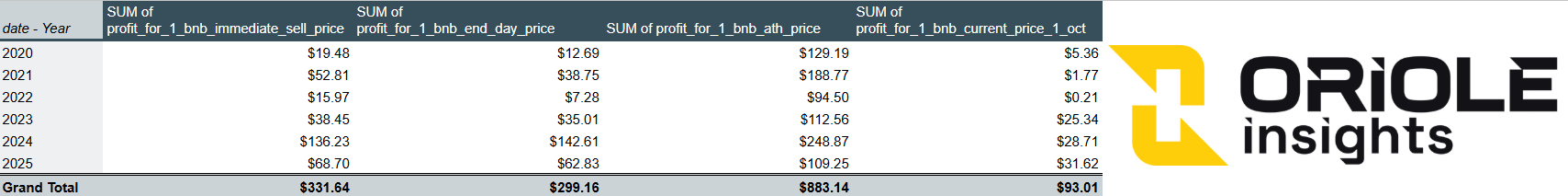

Profit per 1 BNB Across Launchpools, HODLerdrops, and Megadrops

The table below shows how much profit BNB holders could have earned per 1 BNB, depending on when the distributed tokens were sold, during the first minutes of trading, by the end of the first day, at the all-time-high (ATH), or by holding them until October 1, 2025.

Unsurprisingly, the ATH scenario offers the highest potential returns. However, it’s important to note that many of these ATH levels occurred within seconds of listing, often as flash wicks on thin liquidity, and sometimes even limit sell orders fail to execute.

Even if some holders managed to sell a few times near those peaks, it’s far from a consistent outcome, and it’s unlikely that anyone could repeatedly time multiple ATH exits. There are simply too many variables that make such precision practically impossible.

As the data shows, the most consistent and realistic strategy remains selling early, ideally within the first few minutes of trading. This approach yielded about $331.64 per BNB across all years, compared to just $93.01 if holding until today.

However, the end-of-day results also demonstrate solid performance, suggesting that a hybrid strategy mixing early profit-taking with short holds can be effective when market sentiment and project quality align.

Ultimately, the choice depends on timing, context, and discipline, so do your research and stay alert to market shifts.

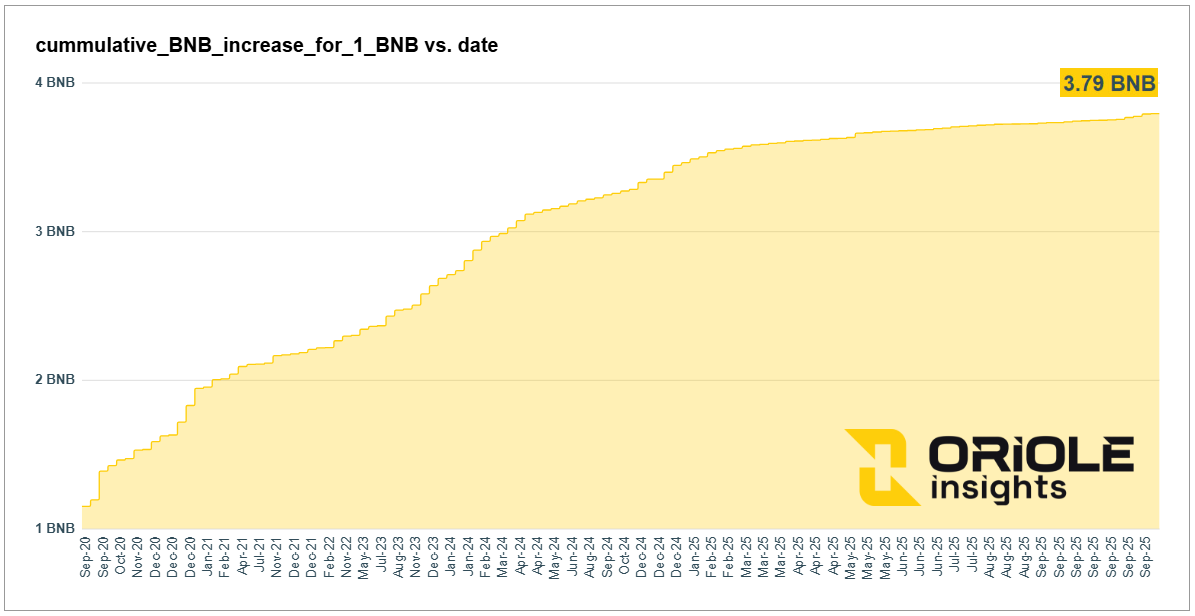

1 BNB Compounding Returns

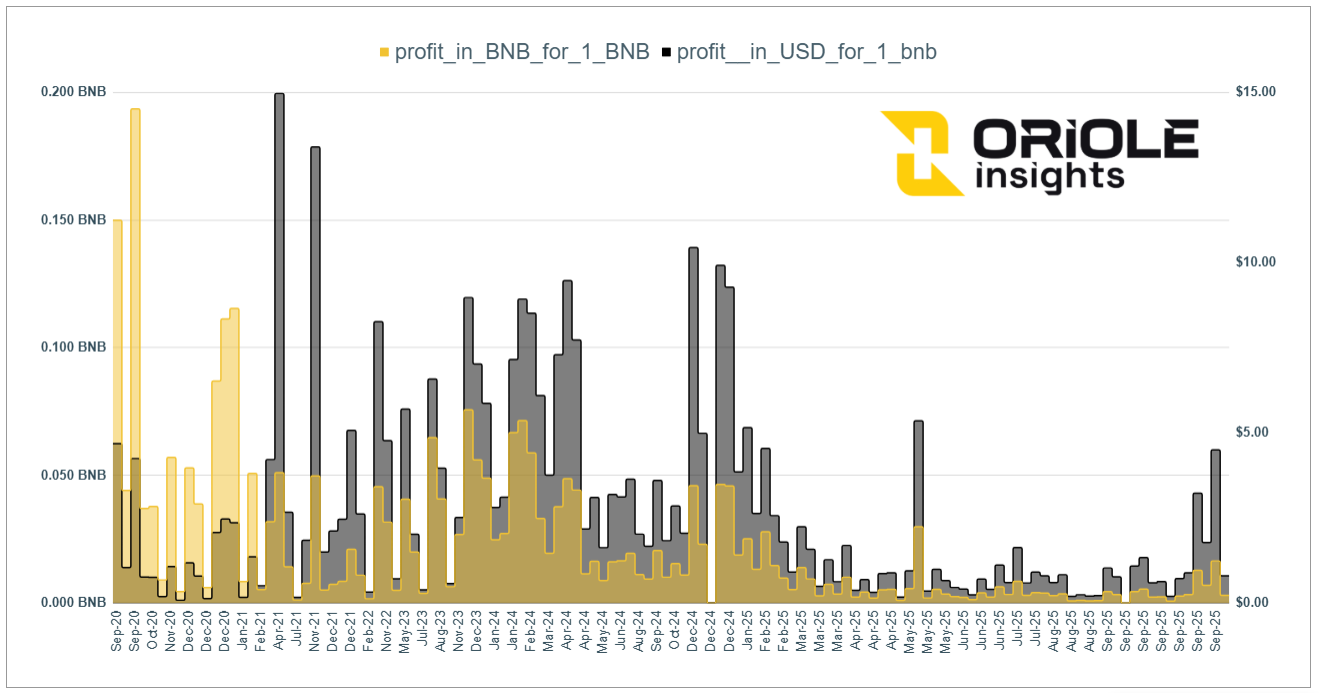

While the previous table shows the static profitability per 1 BNB, the charts below reveal what would happen if every token earned was sold for BNB and reinvested immediately.

The first chart demonstrates the compounding effect in action. Starting from just 1 BNB in 2020, consistent reinvestment would have grown the stack to 3.79 BNB by October 2025 - purely through accumulated campaign rewards. This illustrates how holding and recycling rewards back into BNB could quietly multiply holdings over time, even without new capital inflows.

The second chart breaks that growth down month by month, comparing profit in BNB vs USD. You can clearly see reward spikes aligning with key campaign bursts - most notably early 2021, Q1–Q4 2024, and mid-2025, when Binance’s ecosystem activity and reward flow were at their strongest.

Together, these visuals highlight a crucial insight: BNB’s long-term compounding power often outweighs short-term speculation

$1,000 BNB Strategy

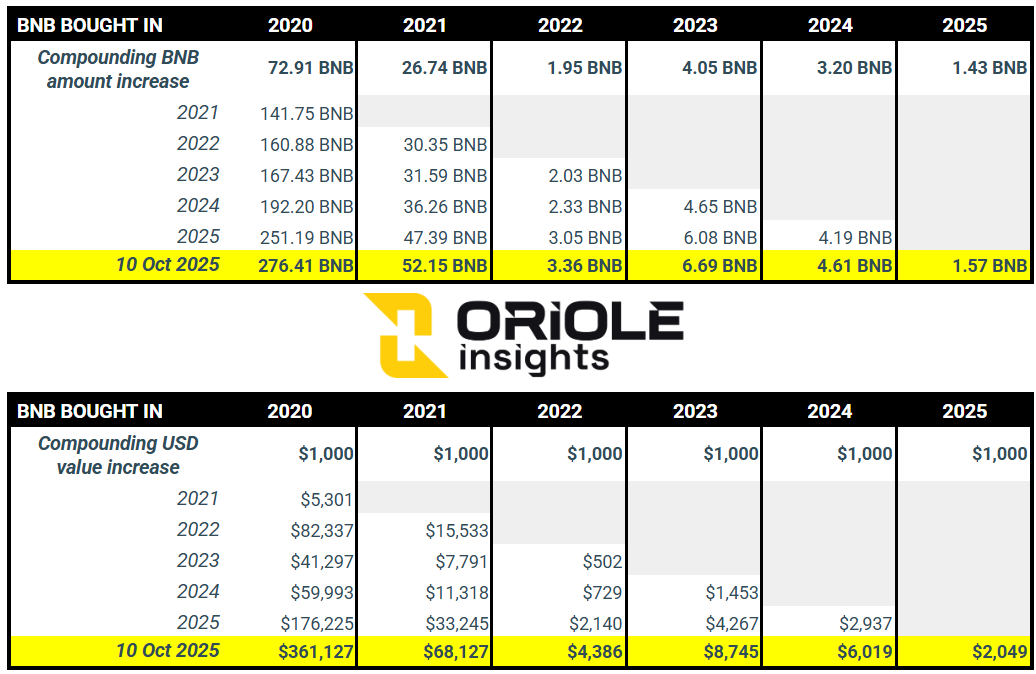

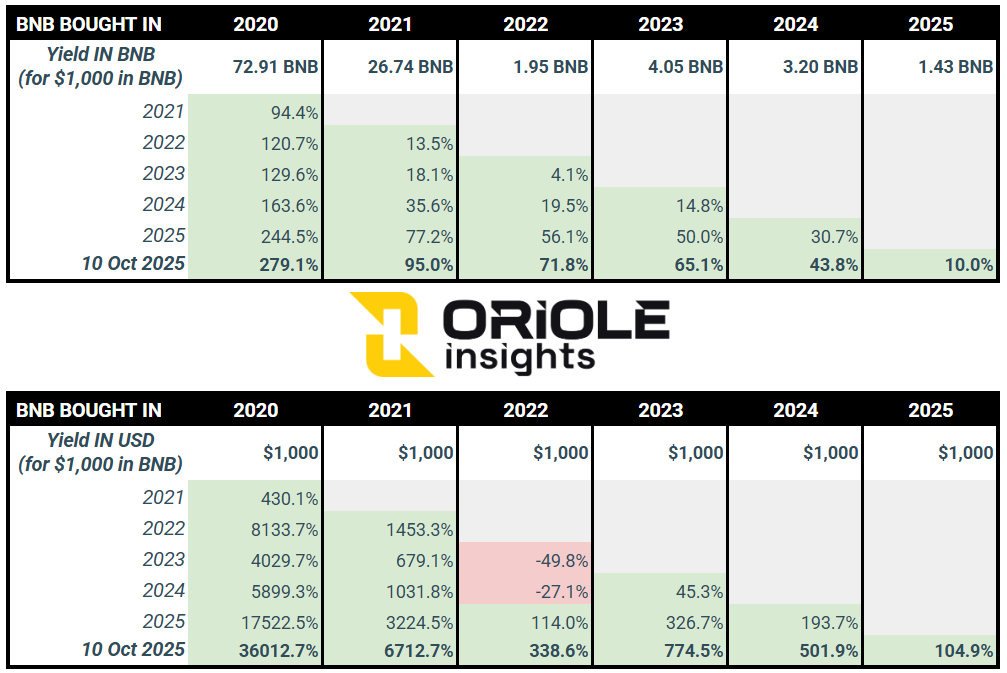

What if you invested $1,000 in BNB at the start of any given year and never sold it?

Instead, imagine that every reward from Launchpools, HODLerDrops, and Megadrops was reinvested back into your stack, year after year.

The tables below model exactly that scenario, starting each year from 2020 to 2025, using a BNB price of $1,306.48 (as of October 9, 2025). They show how your holdings could have compounded in both BNB quantity and USD value over time.

Key Insights

1. Early entry wins exponentially.

A holder starting in 2020 would have grown from just 72.91 BNB ($1,000) to 276.41 BNB ($361,127) by 2025. Even a 2023 starter ends with 6.69 BNB (~$8,745), which is solid but clearly behind those who compounded through more cycles.

2. 2024 was the strongest year across all cohorts.

Rewards peaked that year, with 4–6x growth in BNB and USD value depending on the entry point. Even 2025 remained profitable, proving that Binance’s ecosystem continues to generate yield even in a maturing phase.

3. 2022 shows the bear market effect.

The weakest cohort delivered just $4,386 total from a $1,000 start, reflecting how reduced campaign activity and token prices compressed short-term returns. Yet even here, BNB-denominated growth stayed positive.

4. Compounding turns consistency into exponential growth.

By simply rolling all BNB back into new programs, early entrants achieved a yield of over 270% in BNB and more than 36,000% in USD over five years. Even newcomers in 2024–2025 maintained double-digit annual yields through continuous reinvestment.

This model shows how compounding inside Binance’s reward ecosystem can outperform passive holding or even many DeFi yield models.

No trading, no timing, just consistent participation.

The Real Value of BNB

After analyzing every dataset, campaign, and reward stream, one conclusion stands beyond debate: BNB’s value goes far beyond its spot price.

It is not merely a tradable token - it is a self-sustaining yield engine built on one of the most reliable ecosystems in crypto. Over the years, BNB has evolved from a utility coin into a full-fledged passive income instrument, delivering billions of dollars in rewards to its holders while maintaining one of the most consistent performances across all market cycles.

The numbers speak for themselves:

- More than $4.7 billion distributed through Launchpools, HODLerDrops, and Megadrops.

- Over 60 million BNB have been burned, reducing the supply and reinforcing scarcity.

- Hundreds of campaigns reward users not for speculation, but for participation.

This combination of deflation, consistent reward generation, and ecosystem integration makes BNB a phenomenon with no real equivalent on the market today.

While every investor must decide for themselves whether to buy or accumulate more BNB, one fact is undeniable: BNB has become a benchmark for what a productive, yield-bearing crypto asset can be.

Whether you trade it, stake it, or simply hold it, BNB continues to reward those who stay. And as Binance’s ecosystem evolves, its role as a passive income cornerstone is only becoming clearer.