Successful Predictors on Oriole Insights

Introduction

As our Closed beta is already closes its second month of existence we can see some individuals who put up higher numbers in different spheres. We want to introduce the high-perfmers and take a closer look at their success. This will allow everyone to get a better understanding of which factors contribute to getting to the top.

We will divide our article into three parts. Each will assess the 10 best performers in their respective field.

Reputation

Generally, a high reputation means that a person tends to make more successful predictions than incorrect ones. Here’s a Reputation-gain mechanic.

For each day of successful voting in UP/DOWN markets, the user receives +0.025 to their Reputation. Conversely, for each unsuccessful day, the user loses 0.025 reputations. More here — https://docs.orioleinsights.io/home/whitepaper/core-mechanics-and-reward-system-of-oriole-insights/reputation-system

To understand each user's strategy, we need to get another number. His Reputation to Votes Ratio. This will tell us whether a user is more focused on short-term votes or on long-term votes. We also obviously need to take accuracy into account.

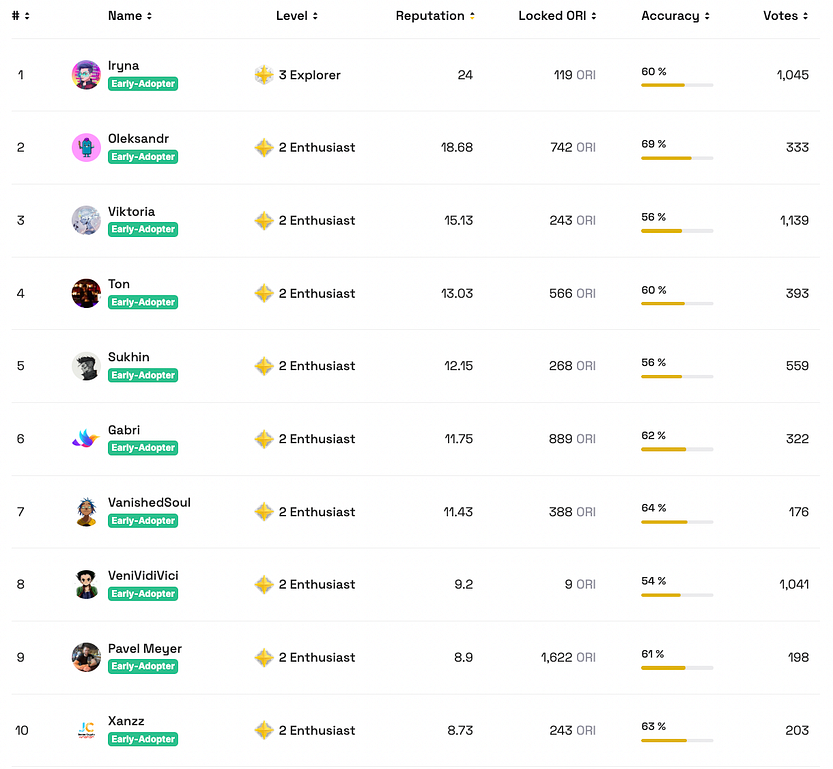

For example, in the picture, you can see the top-3 users. Iryna has R/V Ratio of 43.54, Oleksandr has 17.82 and Viktoria has 75.28. This number represents the average amount of votes needed to get a +1 in reputation. Here, we can see different approaches.

Iryna has a unique and incredible strategy. She is very active with the votes; the prevalent majority is 3 days votes. She also focuses on “DOWN” votes. She analyses the market fluctuations and tries to catch the nearby dip.

Oleksandr has chosen a close yet slightly different approach. His strategy is making votes with a focus on a 7-day periods. One week is a great time period to watch out for a token. He also focuses more on “DOWN” votes yet sometimes has “UP’s”. Oleksandr has a remarkable accuracy of 69%.

Viktoria chooses an exciting strategy with a combined approach. She is very active and looks for any opportunity to place a vote. She focuses on 3 day votes, but when she sees a nice asset she can place votes up to 30 days.

Accuracy

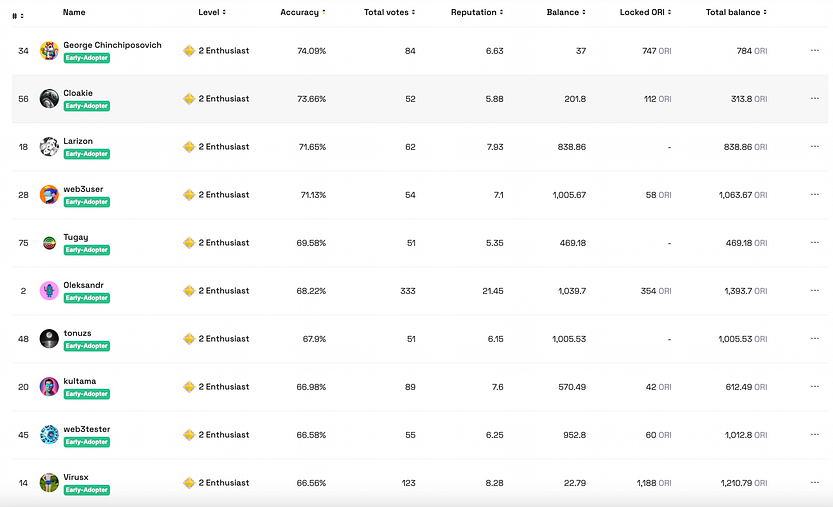

Accuracy is the factor that can show us how deep traders' understanding of the market is. It is worth noting that we only include those who have placed more than 50 votes in this rating. Logically, the more users have voted, the harder it is to keep high accuracy. We’ll look at the users who both got a high chance of winning and those who placed a lot of votes.

Accuracy is calculated as a ratio between the days when the vote proved to be right and the days when the vote proved wrong.

George Chinchiposovich is our leader with an impressive 74.09% accuracy rate after 84. He is notable for his diverse strategy. His latest votes include both “UP” and “DOWN” and all the term periods. The most recent placed vote is a 90-day vote that demonstrates his approach to the market. He also uses hedger perks on long-term votes, minimizing losses and saving ORI.

Cloakie gets second place with 73.66% accuracy and 52 placed votes. He uses a comprehensive strategy of placing short-term “UP” votes on the tokens, which he expects to participate in bullish market dynamics. He actively searches for projects that depend on BTC rise or have the potential for sustainable growth. He also uses 10% hedger perks anytime he places a risky vote.

Larizon gets the third place with 71.65% accuracy and 62 votes. His strategy is centered around fast reaction to market changes. These months, he has bullish sentiment and has placed multiple 7-day “UP” votes. When he is ready to risk, he places 30-day votes and sometimes uses a hedger perk.

Profit/Loss

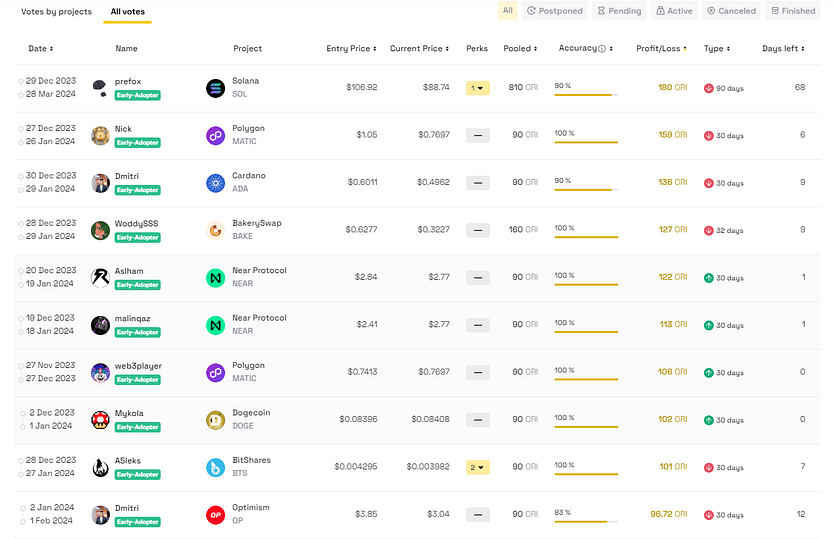

Profit/Loss represents how many ORI a user got with one vote. A higher margin is obviously possible in mid-term and long-term votes, as they have higher daily rewards.

Prefox has placed the most profitable vote with a 90-day “DOWN” vote on Solana. He used a 10% hedger to mitigate the risks posed by long-term votes. He chose SOL because it is a popular and widely analyzed asset. This is important as it gives a common intelligence boost to your voting experience. As for now, the Current Price is below the Entry Price as the user carefully chose a time when SOL was climbing high, spiked by ETF optimism.

Nick places second most profitable vote. It is a 30-day “DOWN” vote placed on Polygon’s MATIC token. This coin is also widely popular so that it can be analyzed within main trading strategies. This vote doesn’t have a perk attached which makes it a bit riskier but requires no additional fees.

Dmitri has the third-most profitable vote. It is a 30-day “DOWN” vote on Cardano’s ADA Token. This vote, even more, outlines the prevalent strategy of targeting widely known network-based tokens. It also shows us that at least at this market part it is more lucrative to place “DOWN” votes.

Conclusion

In this article we’ve looked at the prevalent strategies to reach heights in Oriole Insights predictions. We can outline certain points which reappear in each case.

- Follow the Market. The best vote is the vote placed in times of high market volatility. You can get a spike in accuracy once you follow Bitcoin’s ups and downs.

- Use the Perks. Perks are used at all times for successful votes. The most popular one is hedger for long-term votes. Users choose a lower hedger rate, such as 10 of 20%.

- Find your Strategy. Focus on one particular type of vote, which will become your basic choice. If you are confident placing multiple short-term votes, then you can start placing secure long-term votes.