Plasma $XPL Token Sale - What to Know and How to Profit

TL;DR

- Plasma is a tier-1 project that raised $24M and is backed by Bitfinex, Framework Ventures, Paolo Ardoino, Peter Thiel, etc. The public sale will be held via Sonar by Echo, offering 10% of the $XPL supply at a $500M FDV — the same valuation as its latest private round.

- The deposit phase starts on June 9 at 13:00 UTC. To earn a guaranteed allocation, users must deposit stablecoins ($USDT, $USDC, $DAI, or $USDS) into a Plasma Vault on Ethereum. The earlier and larger your deposit, the more “units” you earn. But keep in mind: deposits don’t buy tokens — you must commit additional capital during the sale phase.

- The user limit is $50M across up to 3 wallets per Sonar account. Global cap starts at $250M. Once the deposit phase ends, all funds are locked for at least 40 days.

- KYC is required via Sonar. Only accredited users from the US can join. Users from the UK, China, Cuba, Iran, Russia, Syria, North Korea, and Ukraine are restricted.

- What to expect? This is shaping up to be one of the most serious sales of 2025. Even with oversubscription, a 20–50% return in 2–3 months looks realistic, and top-tier listings with strong liquidity are highly likely.

- What to do now: complete KYC on Echo, prepare stablecoins you’re comfortable locking up, and be ready for June 9, 13:00 UTC.

What Is Plasma?

Before diving into token sale mechanics or strategies, let’s start with the basics — what exactly is Plasma, and why should anyone care?

Plasma is a new blockchain explicitly built for stablecoins. It’s designed to fix what Ethereum and Tron struggle with — high fees, slow speeds, and poor user experience when moving stable assets like $USDT.

The pitch is simple: fast, low-cost, and secure stablecoin transfers.

Here’s how it stands out:

- Zero-fee $USDT transfers via partnership with Bitfinex and USD₮0.

- High speed, built to handle stablecoin volume at scale.

- Bitcoin integration for added security via a native bridge.

- EVM compatible, so Ethereum contracts work out of the box.

Plasma is purpose-built for stablecoins, and $XPL is what keeps everything running. You don’t have to hold it directly — you can pay fees in $USDT or $BTC — but every transaction still relies on $XPL under the hood.

In simple terms, the goal is to make stablecoin payments feel instantaneous and free, without sacrificing decentralization or composability.

Who’s Backing Plasma and What to Expect?

Let’s take a closer look at who’s funding Plasma, who’s building it, and what all that might signal for the future.

The core team is led by Paul Faecks and Christian Angermayer, a product-focused builder and a seasoned investor known for backing early-stage ventures in crypto and biotech.

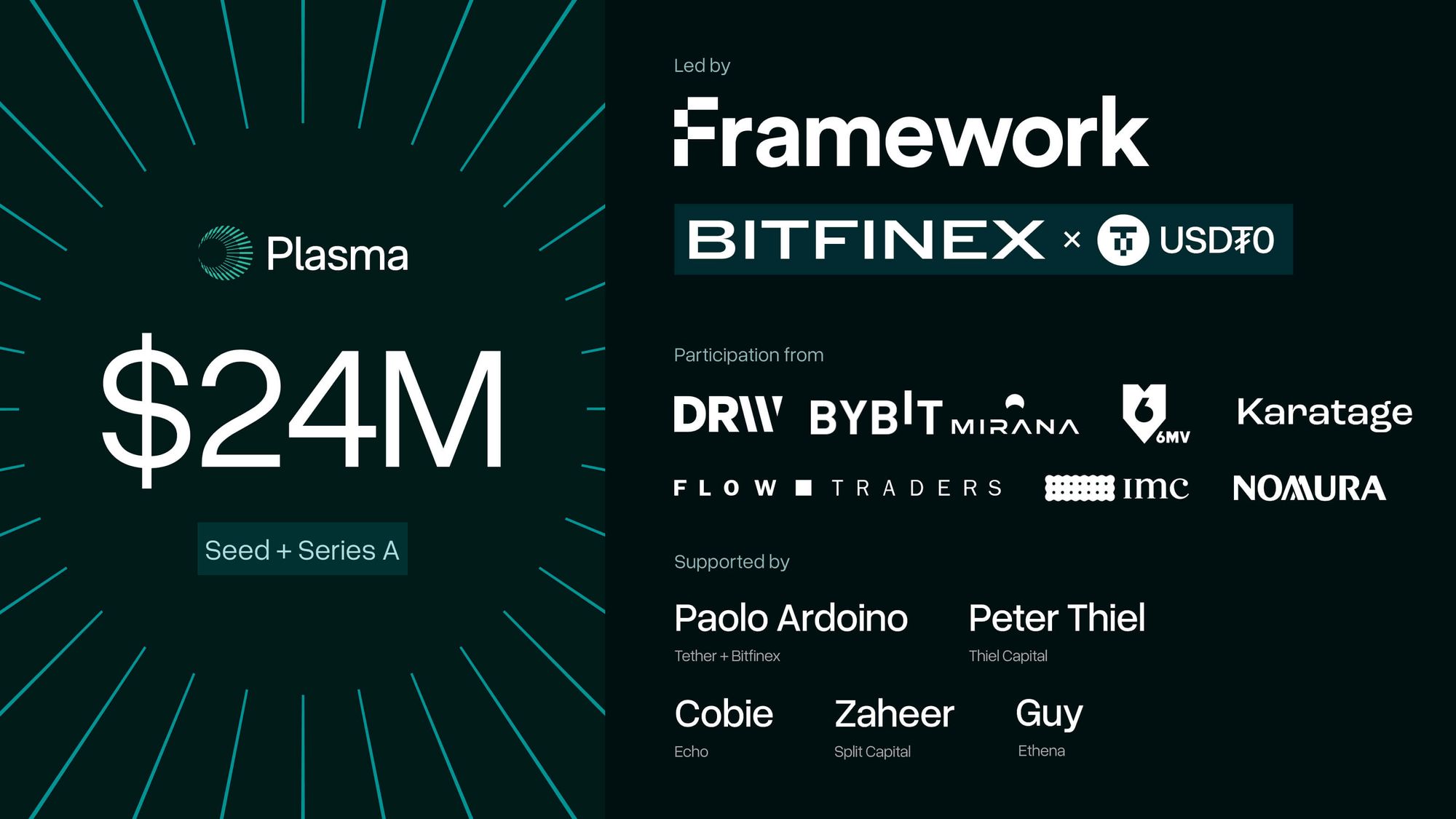

On the investor side, Plasma is stacked:

- The Series A round ($20.5M) was led by Framework Ventures and Bitfinex, and included names like Bybit, 6th Man Ventures, Flow Traders, and Laser Digital (part of Nomura).

- A Strategic round valued the project at $500M, joined by Founders Fund.

- Earlier, a $3.5M seed round in October 2024 included investors like Peter Thiel, Paolo Ardoino (CEO of Tether), and Cobie — some of the most recognizable individuals in the space.

The growth in valuation is notable, with a jump from approximately $40M in October 2024 to $500M by mid-2025, just months apart.

When you combine that with backers like Bitfinex, Tether, and Bybit, the odds of Plasma getting top-tier listings seem high. There’s real momentum here — backed by exchanges, deep-pocketed VCs, and highly visible angels.

As for valuation expectations, it's hard to make clean comparisons. Ethereum and Tron have been live for years, with active ecosystems and established user bases.

But if Plasma can deliver on its promises and capture even a fraction of the stablecoin settlement market, an FDV in the $2.5B–$5B range post-launch wouldn’t be unrealistic, especially if the general market situation is conducive to this.

In short: strong team, strong investors, growing hype, and early backers that know how to push listings forward.

$XPL Token Sale Details

The Plasma token sale will take place through Sonar by Echo — a new public sale platform that will debut with this campaign. It’s different from typical FCFS or other types of IDOs. Instead, it uses a deposit-based mechanism to determine guaranteed allocations.

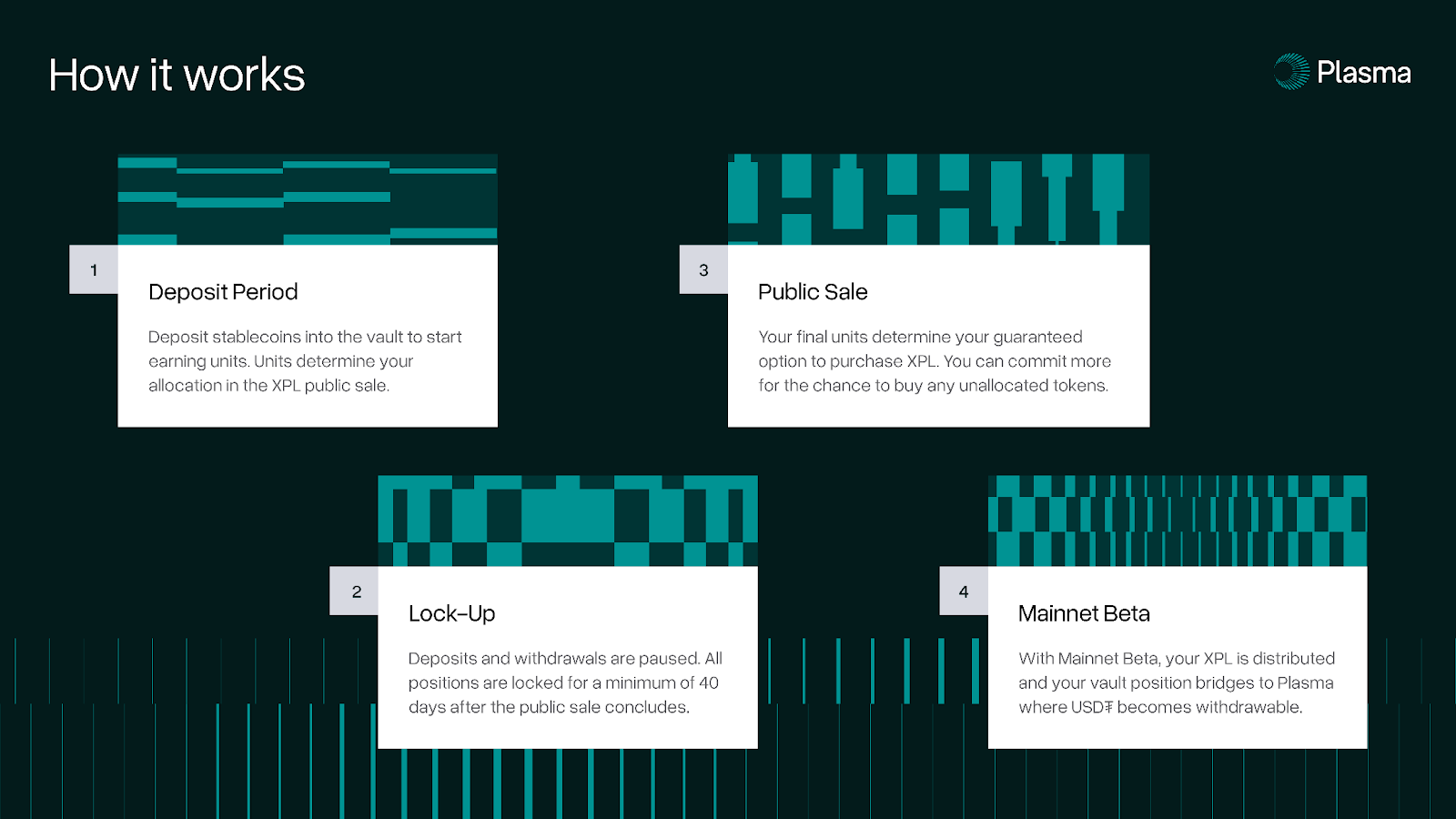

Here’s how it works:

1. Deposit Phase (starts June 9, 13:00 UTC, 2025)

Users deposit stablecoins — $USDT, $USDC, $DAI, or $USDS — into a Plasma Vault on Ethereum. Each wallet earns “units” based on its time-weighted share of the vault. These units determine how much $XPL you’ll be allowed to buy in the public sale later.

- The earlier and longer you deposit, the more units you get.

- Deposits are capped at $250M globally and $50M per individual wallet.

- You can withdraw funds at any time during this phase, but doing so will reduce your units.

2. Lock-Up Phase

Once the deposit window closes, all funds are locked for a minimum of 40 days — no withdrawals or changes allowed. During this time:

- All stablecoins are converted to $USDT.

- At Mainnet Beta, these will become withdrawable as USD₮0 on Plasma.

3. Public Sale

After the lock-up begins, users can commit new stablecoins to buy $XPL. Yes, it’s a separate action — your vault deposit does not auto-buy tokens. You use your earned units to claim your allocation.

- If some users don’t buy their full allocation, the leftovers go pro rata to those who committed more than their guaranteed cap.

- 10% of the total XPL supply will be sold at a $500M FDV.

- You can pay using $USDT, $USDC, $USDS, or $DAI.

4. Distribution at Mainnet Beta

Once Plasma Mainnet Beta is live:

- $XPL tokens will be distributed.

- Deposited vault funds become withdrawable as USD₮0.

- US users will receive tokens 12 months later (standard legal delay for accredited investors).

Additional Details

- KYC is mandatory through Sonar for all participants.

- Citizens from the UK, China, Russia, Iran, North Korea, Cuba, Syria, and Ukraine are restricted.

- Users can connect up to 3 wallets to a single Sonar account.

There’s still no published tokenomics beyond info that 10% of all $XPL is allocated for sale, so that you won’t find vesting charts or team allocations just yet — expect more clarity once the sale begins.

$XPL Sale Strategy (DYOR!!!)

There are two camps when it comes to the upcoming Plasma token sale.

One group sees it as a “whale game” — with high-cap players dominating the allocation and leaving scraps for smaller users. They argue the returns won’t be massive: maybe +25–50% over a few months, and for that reason, it’s not worth the effort. “No real x’s,” they say.

The other side — arguably more grounded — views it as one of the few serious, well-backed opportunities in 2025 that even offers any realistic upside. In a market where 20% APY is already a win, getting early exposure to a Layer 1 backed by Bitfinex, Founders Fund, Paolo Ardoino, and Peter Thiel, at the same FDV ($500M) as its private round, is a rare alignment of access and potential.

It’s not about finding instant “10x” plays. It’s about stacking stable, asymmetric bets when the market isn’t flooded with hype. Worst case? A modest return. Best case? You caught the next major L1 coin early.

Key Points to Keep in Mind:

- Not everyone can participate. The sale excludes users from certain jurisdictions (including Ukraine, Russia, China, UK, and others). If you're in a restricted country, you'll need to explore alternatives — perhaps via a trusted person with access in an eligible region. Don’t take unnecessary risks.

- Your deposit ≠ your allocation. Stablecoins deposited into the vault only earn you “units” — points that determine your guaranteed allocation. You still need to commit funds during the sale itself to buy $XPL.

- Funds are locked. Once the deposit phase ends, funds are locked for at least 40 days. Realistically, you're looking at 2–3 months before anything becomes liquid. Don’t deposit what you might need soon.

- Multi-accounting doesn’t help. You can only connect up to 3 wallets to a Sonar account. The per-user cap is $50 million. So for 99% of participants, there’s no point trying to “game” the system.

- No tokenomics yet. At the time of writing, there’s no official breakdown of token supply, emissions, or unlocks. The only known figure: 10% of the total supply will be sold in this public sale at a $500M FDV. Keep an eye out for more details when the deposit window opens.

What to Do Now:

- Complete KYC at Echo — better now than at the last minute. This will be mandatory for all participants.

- Decide how much capital you're willing to lock up for a few months. Think in risk-adjusted terms.

- Stay alert — the deposit period begins June 9, 13:00 UTC. Timing matters when it comes to earning units.

- DYOR. Just because the setup looks promising doesn’t mean it’s risk-free. Stay sharp.

Bottom line: Plasma isn’t some overhyped, clickbait Token Sale. It’s a serious attempt to build stablecoin-native infrastructure, backed by substantial investment. If you understand what you’re getting into, this could be one of the few fair public rounds worth playing in 2025.

What Insights Can Oriole Give You?

One of the best ways to gauge sentiment before a token even launches is by seeing how the market thinks. That’s where Oriole Insights comes in.

Through our ROI & Initial Listing Prediction Markets, we regularly add tokens from upcoming sales, including public rounds like Plasma’s, and let the community vote on expected roi/price ranges/market cap post-listing. It’s a simple but powerful way to measure collective conviction, filter through hype, and adjust your strategy.

Take these recent examples:

- $WCT (WalletConnect): The community predicted it would list between 1.25x–2.5x. Final result? ~$0.345 on listing vs a $0.20 sale price. Spot on.

- $OBOL (Obol Collective): Most predictors expected a 1x–2x listing range. It opened at ~$0.43 off a $0.25 sale — again, the crowd nailed it.

When $XPL tokenomics go live, we’ll be adding it to the prediction market as well. That means you’ll be able to see where the community thinks it might list — and more importantly, whether expectations are low, mid, or moon-level.

You can use these insights to:

- Decide if the current valuation is attractive;

- Adjust your entry or exit based on expected ROI;

- Avoid overhyped launches with poor expected returns;

- Confirm (or challenge) your thesis before locking capital.

Oriole Insights isn’t a magic oracle. But it’s a real-time strategy layer that helps serious participants read the room and make sharper decisions — especially when alpha is limited and timing matters.

Final Thoughts

We’ve broken down Plasma Token Sale from the ground up — what it is, who’s backing it, how the sale works, and what you should realistically expect. Whether you're new to public rounds or already deep in the game, the takeaway is the same: this isn’t just another overpromised L1.

It’s one of the few well-funded, infrastructure-first plays in 2025 that’s giving retail users access at the same valuation as top VCs. That alone makes it worth watching.

Will it moon? That depends on execution, sentiment, and market timing. But with strong fundamentals, credible backers, and a cleaner mechanism than most, the risk/reward looks fair, especially if you understand what you’re locking up and why.

Stay sharp, stay early, and stay skeptical — but don’t sleep on real chances when they show up.

Related articles