Decentralized Validation in ROI & Polls Prediction Markets

Introduction

During Closed Beta and Public Beta, Oriole Insights sought to test and constantly improve the platform correctly.

One of the most critical stages of the ROI & Initial Listing Prediction Markets and the newly added Polls Prediction Markets is the final result, due to which the correct option is determined and rewards are distributed among the winners.

During the ROI & Initial Listing Prediction Markets testing phase, 71 projects were added, and 18 356 ROI/price predictions were placed. Oriole Insights ' decision determined the correct outcome for each prediction market. With such a broad base of cases, it was not always possible to say for sure that one or only one of the options is correct, but it became clear that a decentralized approach to determining the correct option is necessary to improve a community-driven platform.

We are excited to introduce a new feature, “Validation,” to our ROI & Initial Listing Prediction Markets and Polls (Binary & Categorical Prediction Markets)!

This innovation represents a significant step towards a more decentralized solution, underscoring our community’s commitment to transparency and honesty. This new feature aims to address and resolve the challenges faced in accurately defining market outcomes by empowering our trusted community members to validate prediction outcomes. Moreover, Validators will be rewarded with extra ORI from the separate Validators’ Reward Pool.

OLD Outcome Determination System — ROI

The previous mechanism in ROI & Initial Listing Prediction Markets used the closing price of the 30-minute candle, paying attention to Tier 1 exchanges and/or exchanges with the highest reported volume of the specific token.

However, it can be criticized for only sometimes reflecting the most accurate or fair market price. This can lead to confusion and dissatisfaction among predictors, who sometimes need help understanding the rationale behind the chosen benchmarks.

Why Decentralized Validation is Better for ROI & Initial Listing Prediction Markets?

Decentralized validation offers significant advantages over centralized validation in ROI & Initial Listing Prediction Markets due to several inherent challenges associated with centralized methods:

- Tokens often list on multiple exchanges but not simultaneously. This staggered timing leads to discrepancies in initial trading data.

- In the first minutes or hours after a token listing, exchanges may keep withdrawals closed. This restriction prevents arbitrage opportunities that would help equalize prices across platforms - consequently, significant price differences can occur between exchanges.

- Parts of a token’s supply intended for initial circulation can be delayed in unlocking for investors or the community. This delay means the initial circulating supply is critically low, potentially inflating the initial price.

- Technical Problems on Exchanges, such as delays in token deposits or trading halts, can influence trading data.

By embracing decentralized validation, the platform leverages the collective expertise and vigilance of the community to navigate these complexities.

Validators collaboratively assess data from multiple sources, consider the timing of listings, account for withdrawal restrictions, and factor in tokenomics intricacies. Decentralized validation mitigates the risks of relying on potentially flawed or incomplete centralized data, ensuring the final results reflect a comprehensive and equitable analysis.

Case Study(ROI): Massa Token Listing on Bitget and MEXC

The example described below reflects why decentralized validation is necessary.

In a recent scenario involving the listing of Massa ($MAS) on the cryptocurrency exchanges Bitget and MEXC, Oriole Insights’ prediction market faced a unique challenge due to variances in the closing prices across different platforms.

Details of the Case:

Massa $MAS was listed with its 30-minute closing candle prices differing slightly between two exchanges:

- Bitget: 30-minute canldle closed at $0.11

- MEXC: 30-minute candle closed at $0.13

The possible prediction ranges were the following:

1. 0.5x — 1x ($0.06 — $0.12)

2. 1x — 5x ($0.12 — $0.60)

3. And so forth up to:

10. 100x — 200x ($12 — $24)

So, the 30-minute candle close prices were slightly different, but it affected the decision-making process for the right outcome. While the closing price on Bitget fell within the first variant, the closing price on MEXC crossed into the second variant. This discrepancy led to difficulties in definitively determining the correct prediction range.

Oriole Insights declared BOTH TWO, the first and second prediction outcomes, correct to address this discrepancy. However, this decision also illuminated the inherent challenges of relying solely on centralized decision-making and the need for a more nuanced approach, especially in scenarios involving multiple data sources with slight variations.

How Validation Works

Introducing a Decentralized Validation Approach

In response to these challenges, Oriole Insights is set to introduce a new feature: Validation by eligible and trusted users. This approach aims to decentralize the decision-making process and enhance the reliability of the outcomes in the prediction markets. So let’s figure out what it takes to become a validator and what are the duties:

Requirements for Validators

Each market, be it ROI & Initial Listing Prediction Markets or Binary & Categorical Prediction Markets, has corresponding requirements to make a prediction and, in our case, requirements for Validators. Only users with a specific User Type and/or Level can be validators.

❗️Validators cannot participate as predictors in the markets they validate, ensuring impartiality.❗️

Reward System

Validators are incentivized through a Validators’ reward pool — each pool differs from market to market. The reward will depend on a particular validator’s Reputation and the total number of Validators(disturbing rewards proportionally). Both agreeing and disagreeing validators are eligible for rewards, fostering a balanced view.

Validation Mechanics (Briefly)

Validators are presented with a proposed correct option (by Oriole Insights) and can either agree or disagree. A delta must be reached before the decision can be finalized.

Note: Validation Delta — the difference required in validator votes to determine whether an answer is correct or not. This difference can be either agreement or disagreement. When the delta is reached, it signifies a consensus level among validators, leading to either a re-selection of the correct outcome or confirmation of the initially selected outcome.

Resolution and Rewards

If the validators reach a consensus, the market enters the finished stage, and rewards are distributed to successful predictors from the accumulated pool of incorrect predictions and the Seed Pool.

Validators receive their rewards from the Validators’ Pool. If a consensus isn’t reached, Oriole Insights proposes an alternative outcome, and the process is reiterated.

Validation process visual example — Polls:

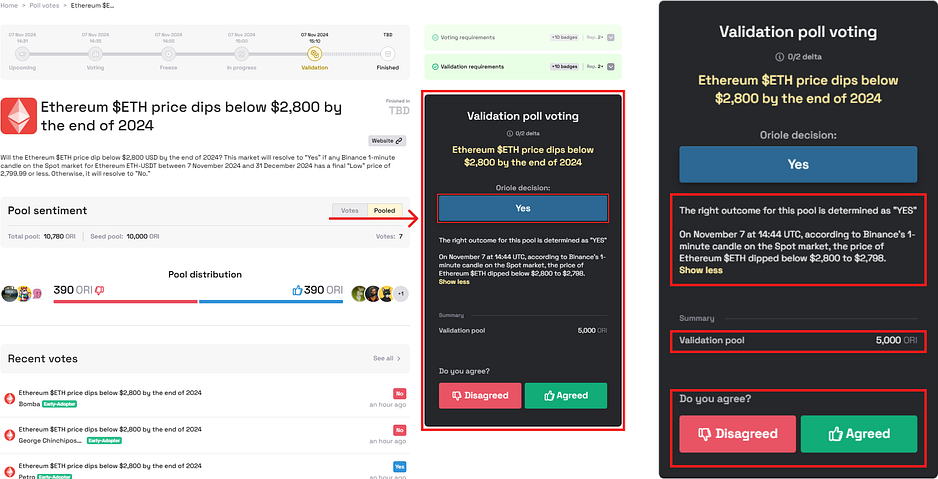

When users navigate to the validation section of the Oriole Insights platform as validators, they are presented with a clear and structured interface that guides them through the decision-making process.

1. The beginning of the validation stage

First of all, at the beginning of the Validation stage (if the user met the requirements for a validator and did not participate in predicting this market), he will see a sidebar on the right in which the validation process will take place, information will be provided, and progress will be visible.

Actions for Validators:

- View the “delta” defined for this Validation. Visually, it is located from the very top above the name of the market.

- Check out the Oriole Insights decision and read the provided explanation.

- Check the Validation pool to understand how much ORI rewards will be distributed after validation ends.

- Click the “Agree” or “Disagree” button based on your independent decision. Your decision will contribute to the validation process and will be counted toward reaching a consensus.

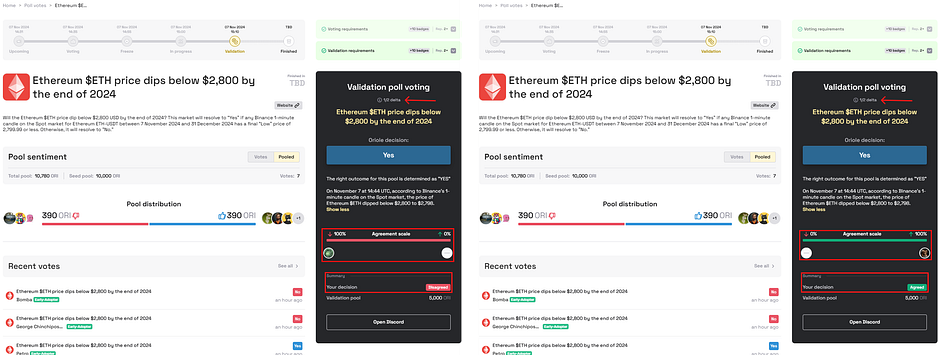

2. Ongoing Validation progress

After making the decision, the validators wait for the validation's end. During this, they can:

- Observe on the “Agreement scale” — what decisions other validators make and how this affects the achievement of the delta.

- Check an updated Summary with the specified validator’s decision.

3. Validation result

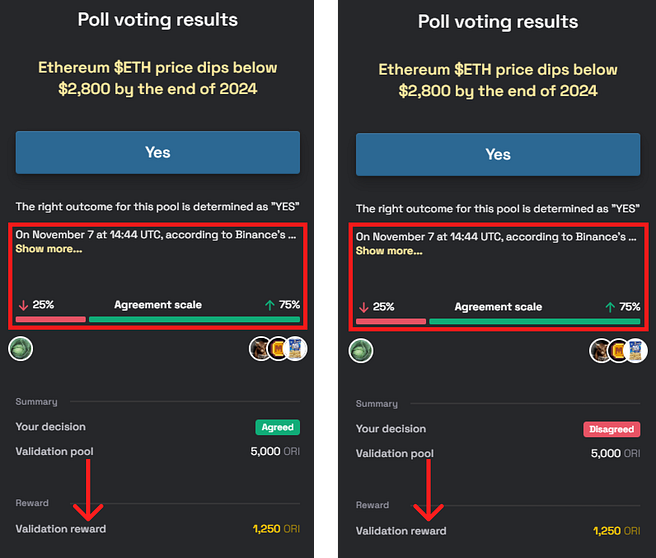

If the validators disagree with the decision, the same process will occur again with a new proposed Oriole decision for validation. If the decision was agreed upon, the validation is considered finished.

Validators can see in the interface:

- Final “Agreement scale” — which of the validators agreed or disagreed.

- Validators' reward — distributed from the Validation pool based on reputation and the total number of validators.

Being a validator ensures the prediction market’s fairness and reliability. Your expertise and input help shape the outcomes and reinforce Oriole Insights’ platform’s community-driven nature.

Conclusion

This new validation feature is expected to improve the transparency and fairness of the prediction outcomes and empower the community by involving them directly in the validation process.

By addressing the complexities and challenges of predicting market behaviors, Oriole Insights is poised to refine its platform, offering a more robust and community-driven approach to predicting in the crypto space. This evolution marks a significant step in the maturation of predictive market platforms, potentially setting new standards for decision accuracy and user engagement in the broader predictive market ecosystem.

We also remind that to interest our users to engage with the platform and try predictor`s skills with new Polls (Binary & Categorical Prediction Markets) and provide feedback that will accelerate the process of improving the platform, Oriole Insights has launched a Galaxy campaign with $1,500 USDT & 1,000,000+ ORI Prize Pool: